Not just Bitcoin: the application areas of Blockchain in Italy

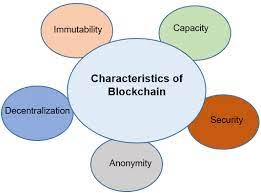

Blockchain is not just Bitcoin. Virtual currency is in fact only one of its possible applications. Without centralized management, in fact, the Blockchain allows you to send any data in a secure manner, drastically cutting the chain of intermediaries, and therefore allowing a secure exchange of data between two people and that’s it, without having to use third-party means such as for example a email provider, or an external Cloud Computing service.

The important role of Finance and the growth of “Non Finance”

Observatory of the Polytechnic of Milan (2017)

Observatory of the Polytechnic of Milan (2017)

World Economic Forum

There was a lot of talk about Blockchain also at the World Economic Forum (World Economic Forum) and there are many investors who are aiming for other investments in the Blockchain field, and therefore from the initial investments that there have only been in the new currency and in new systems of payment, we finally move on to new investments, in new and different sectors.

PWC

In an analysis carried out by PWC in 2018 with the involvement of 600 executives from 15 different countries, including Italy, represented by 46 respondents, it emerged that 84 percent of respondents are involved. In particular, 20% are still engaged at a research level, 32% in the development phase, 10% are working on pilot projects, 15% are with blockchain in production while 7% declare they have projects started, but for for some reason then blocked. Only 14% have no active or planned involvement in blockchain.

Deloitte

According to Deloitte, over 1 billion dollars have been invested in Blockchain, in over 120 startups connected to Blockchain, of which over half of this money was invested in 2016 alone, an important confirmation then came in 2017 and from the commitment and from the investments of many companies in the 2020 time horizon.

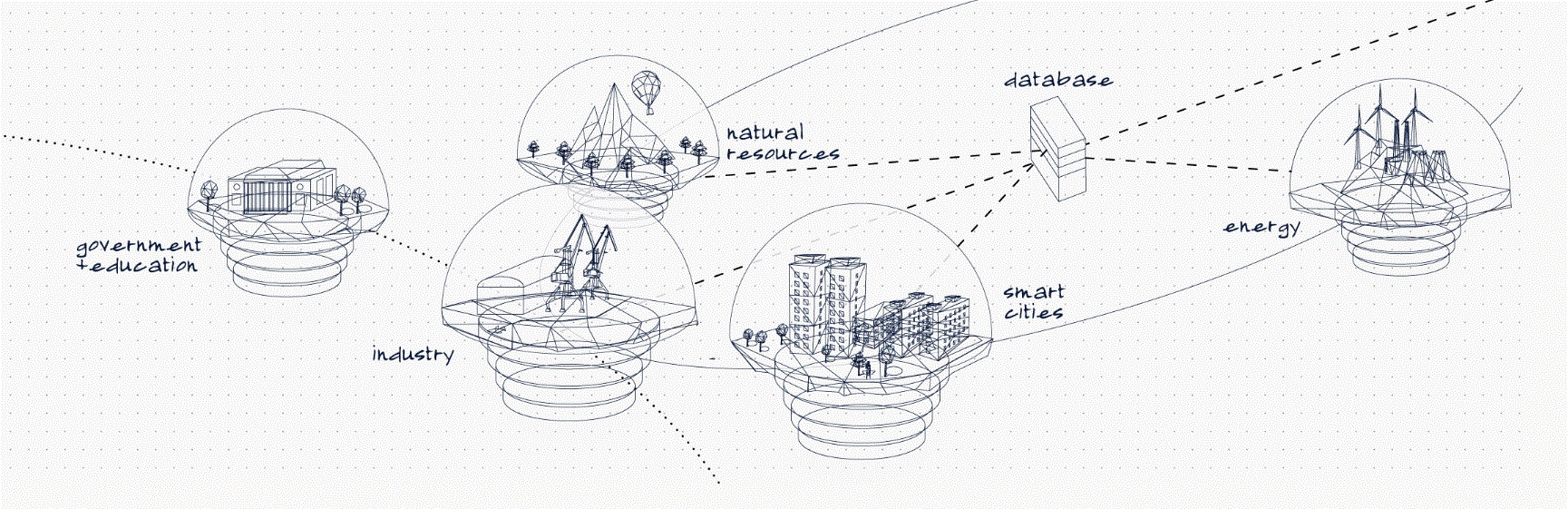

Let’s see what the main ones are among the new application areas of Blockchain in Italy and around the world.

1) Blockchain in Finance and Banking

Finance and Economy are certainly among the sectors most targeted by investors in relation to Blockchain. In fact, since there are no intermediaries to manage transactions, the Blockchain would reduce the costs of bank commissions, allowing savings, speed and reliability of transactions. It therefore becomes essential to invest in this new technology for banks and financial institutions, which are trying to grab a fairly large slice of this new market, which immediately reveals countless possibilities and opportunities. On blockchain4innovation.it the section dedicated to Blockchain in Banking and Finance is available, which offers a broader vision and an in-depth focus on the topic of banking and finance in general and on how this market is evolving with an eye to new Blockchain technology.

2) Blockchain in Insurance

Furthermore, as highlighted by a study conducted by Ernst Young, there is also an excellent possibility of use for Blockchain in the insurance sector (Insurance). Some ways through which Blockchain can help insurance are:

Access to secure and decentralized transactions, which provides a solid foundation to prevent fraud, to ensure greater governance, to have better data and reporting. Furthermore, thanks to Blockchain, insurance companies can have updated and accurate notifications in relation to changes, and this allows them to improve risk management and maximize capital and fund opportunities, as well as the possibility of adopting Big Data strategies, which are very useful for obtaining secure information about your customers, their priorities and preferences, as well as any further information taken from third parties.

From a technical point of view, insurers see Blockchain as an opportunity to integrate a third-party ecosystem to reduce the costs of their management platforms, while improving customer experience and market share, and developing new solutions and opportunities.

At a market level, insurers also have opportunities in the governance of their companies, through improved data access, third-party controls and more sophisticated risk management systems, associated with their products and services, such as cyber insurance .

3) Blockchain in digital payments

Even when it comes to Digital Payments there are great opportunities for Blockchain. Obviously there are still many issues that need to be addressed, such as the processing time of a transaction, which is still very slow considering the needs of an increasingly faster market and world. The performance of the system should also be improved, in order to be better absorbed by digital payments, and similarly clear regulatory indications and a more careful analysis of threats and opportunities are the challenges of Blockchain in the digital payments sector. Despite these challenges, however, there are many opportunities for this new technology applied to digital payments, and we will probably have the first feedback from the market very soon.

4) Blockchain in Agrifood

In Agrifood, blockchain finds a further excellent “ally”. Some of the application characteristics of blockchain in Agrifood are the traceability, transparency, of those who want to “tell the story” of their food, using the blockchain to guarantee reliability. Other companies already want to track containers and transport of food and food in general using the Blockchain. In conclusion, the benefits of blockchain in Agrifood are multiple, and from decentralization, to shared control, to the immutability and preservation of information, there are certainly many applications for blockchain in the Agrifood sector.

In particular, the benefits of blockchain appear particularly important for the processing industry and for all activities and developments related to food certification. The blockchain allows the creation of open supply chains in which all the actors: producers of raw materials, companies that deal with logistics and transport, companies that operate on raw materials at various levels of transformation, companies that work on packaging and marketing. finally, retail can provide data and information and control, with maximum transparency, the data of all other actors. And the data relating to each product can be made available to the end consumer. In this way, blockchain allows us to create more open, more efficient and safer supply chains.

5) Blockchain in Industry 4.0

Even in manufacturing, Blockchain can be a valid ally. Thanks to the Blockchain in Industry 4.0, in fact, it is possible to exploit the decentralized logic of the Blockchain to produce technologies capable of best supporting production, logistics and supply chain, as well as other “core” areas of the company. Furthermore, thanks to the Blockchain, it is possible to preserve the data and the security of the data itself, thus guaranteeing security and reliability throughout the entire production and distribution chain process. Blockchain makes it possible to have solutions in particular for the processing industries, for the management of internal and external product logistics and for the management of supply chain relationships. In particular, solutions have been developed that allow us to bring the “Trust” logic which is widely used in the field of digital payments also in the field of transactions which have as their object “packages” of data which represent the identity of certain products and their production logics. In these cases it is necessary to have maximum reliability in terms of identity management and trustworthiness. In this case, Blockchain can represent an excellent solution for implementing Industry 4.0 logic at district and supply chain level.

6) Blockchain in the IoT

Even in the Internet of Things, Blockchain finds great utility: thanks to its ease of data exchange, in fact, Blockchain technology could be used to facilitate communication between connected IoT objects, as well as making data exchange safer and faster. The blockchain is then used as a platform for solutions that aim to manage the identity of things. Thanks to the correct identification of this identity it is possible to create supply chain certification solutions also based on the data arriving from things (IoT) and work on supply chain certification. One of the most significant examples is that of the food supply chain.

But why is the safe recognizability of objects and therefore the issues of identity management in the Internet of Things so important? Today it is important to make the end-to-end recognition of virtual or physical objects increasingly secure, because it is with these objects that the intermediation of people themselves in transactions takes place. That is, they are the objects that ultimately manage transactions. Today, thanks to user IDs and passwords or the use of special certificates, we are able to identify people, but people “make themselves identified” thanks to objects. In certain cases – increasingly frequent – there are objects that need to be identified without there being people behind them. So if, thanks to blockchain, we can identify objects, we would have a new, safer identification tool, even for people.

7) Blockchain in Healthcare

As regards Blockchain and Healthcare, managing patients’ medical data through a shared system would allow doctors to share patient information in a safe and fast way, and would therefore greatly help medicine and healthcare to improve the service provided to patients, with the possibility of having a patient’s entire medical record under control, and therefore knowing the patient’s history in advance, in order to administer better treatments more quickly.

The blockchain allows you to create an organization that realizes the true centrality of the patient together with the intelligent coordination of all the medical actions that affect him. Considering that healthcare services are provided by different structures with very different digital “stories”, blockchain can help create intelligent coordination of all actions thanks to a review of management, interoperability between heterogeneous structures and information. Blockchain technologies, by their nature, can contribute to providing new answers in terms of progressive interoperability between national health information systems. Blockchain is also an answer in terms of regulatory compliance (Gdpr, Nis Directive) in complex scenarios that must manage the presence and interaction between interregional healthcare systems, between private entities such as analysis laboratories, private healthcare facilities or insurance too.

Blockchain opens up new scenarios to “improve auditing procedures, for security, to reduce possible attacks, for the management of patient data to develop new authentication methods. Last but not least, the topic of “Smart Contracts” which can speed up the control procedures and operational mechanisms of hospital facilities and can, together with data management services, bring very important efficiencies at the level of secure document management. It should not be forgotten that in the healthcare world there is the huge issue of the multitude of sources. For example, there is no single national register regarding pharmacological therapeutic prescriptions, but multiple sources, often fragmented, must be coordinated. secure, decentralized and “immutable” document management can provide new answers in terms of speed of access to the data you need when you need it.

8) Blockchain in Public Administration

Blockchain also has areas of application in the Public Administration. In fact, Blockchain could, for example, help the Public Administration and citizens to have a true digital identity, shared and implemented in this system, with various advantages including: making tax evasion more difficult, having greater control over citizens and therefore combating crime, simplified services in all sectors of the Public Administration (simplified data sending), and much more.

9) Blockchain in Retail

The Blockchain seems to be an interesting model to use in shops and retail: with the Blockchain, in fact, current in-store payment methods could be extended to Bitcoin, thus allowing customers to pay much faster, as well as cheaper. By guaranteeing faster and cheaper payments, and therefore more convenient, a better service can be offered to the customer, which could therefore give a competitive advantage to the stores that decide first to enable these new technologies in their points of sale.

10) Blockchain in music

Copyright management has always been one of the most controversial and complex issues in the recording market. This is a market that has experienced a real transformation dictated by digital before and more than others. Indeed, it can be said that it is a market that has undergone more than one transformation and where the issue of the remuneration of all the players in the supply chain has always been complicated, to say the least.

The exchange of musical pieces or their diffusion on a large scale, in the absence of correct remuneration for the authors and for those, such as arrangers and musicians, who contributed to the creation of the musical product, has caused discussion and has seen attempts of all kinds.

Thanks to the blockchain, smart contracts and the initiative of various startups, it is now possible to automate the remuneration, in part, of the supply chain of authors and contributors to music, for each of our purchasing decisions. The determining point remains contained in this last word: purchasing choice. It must be a transaction, i.e. the purchase of a song or the subscription to a service.

11) Blockchain and Smart Grid

The “smart grid” brings the concept of “intelligent grid” to the field of electricity. We have always been accustomed to using electricity as consumers. We are certainly not used to living this dimension as producers, even if we find ourselves or can find ourselves being one more and more often.

The electricity grid is not a single relationship from the producer to the customer but has a multiplicity of possibilities starting from the citizen who produces and makes his energy available on the grid. But energy must be produced when it is needed or used when there is excess. In other words, intelligent management of production and consumption is needed.

Smart Grids use analytics and exchange platforms to manage consumption and production as precisely as possible and naturally to reduce waste as much as possible. The blockchain can play a very important role in the management of incoming and outgoing transactions with a method that allows the electricity grid to be made more “democratic”, i.e. a method that also allows exchanges between those who have excess energy to be managed and those who have urgent needs.

The research company Markets and Markets predicts a 78% growth in 2018 in the use of blockchain for the energy market but above all it predicts a development of the sector which should lead the blockchain – energy relationship to generate a business volume of over 7 billion dollars in 2023 compared to a volume that in 2017 was just under 400 million dollars. Among the most important items that will support this demand are payment management, Smart Contracts and pricing management.

From alternative to traditional finance to ally of banks

Blockchain technology, on the other hand, definitely has a future. On the occasion of the international events organized on the topic in recent months, in London (25-26 January), San Francisco (10 February) and Johannesburg (3-4 March), IT giants – such as IBM and SAP – will sit at the same table and independent developers, addressing an international audience composed mainly of financial and credit institutions.

The interest of the banks, moreover, has no longer been a secret for some time. Goldman Sachs has declared that Blockchain is destined to revolutionize the sector, while Barclays and USB have publicly admitted that they could use the technology in various operational areas, from payment remittances to contracts. Bank of England has made it known that it has created a number of development teams within its organisation. In September, however, R3 was born, a private consortium of financial institutions interested in the potential of Blockchain. In December there was a new round of memberships, which saw the entry of BMO Financial Group, Danske Bank, Intesa Sanpaolo, Natixis, Nomura, Northern Trust, OP Financial Group, Banco Santander, Scotland bank, Sumitomo Mitsui Banking Corporation, U.S. Bancorp and Westpac Banking Corporation. Today, a total of 42 institutes have joined the federation. Meanwhile in Italy even the largest credit institution, Unicredit, considers Blockchain one of the digital investment priorities of 2016 and 2017.

But there are also those who have already moved from words to deeds: Bank of America has filed with the U.S. Patents and Trademark Office (USPTO) 15 patents related to Blockchain and is expected to file twenty more in these days. According to what was made public by the USPTO, Bank of America’s patents aim to create systems for identifying risks related to cryptocurrencies and alerting suspicious users.

Obviously there is a downside to the coin. If on the one hand banks are attracted by the possibility of activating cheaper and safer transactions, on the other the idea that those who participate in the network can see in real time the data circulating through the nodes chills the enthusiasm of those who don’t want to that their transactional flows become public knowledge. It is therefore necessary to ensure that each user has the credentials to see only the operations that concern him. This is one of the most debated topics at the Blockchain Conference in London: together with those of the regulation and complexity of data protection tools to be adopted at the level of international jurisdiction, it was indicated as one of the most delicate issues for the diffusion of the technology.

The other possible application areas, from PA to businesses

But it is not only banks that consider Blockchain a strategic development lever. If many observers say they are convinced that even the practices of the Public Administration and even registry records and identity documents can be managed by exploiting the distributed control systems offered by the Blockchain (applicable even to notary activities or the management of intellectual properties), we begin to evaluate the positive impact of technology on private businesses as well.

Also in London, the usefulness of Blockchain for simplifying business processes, reducing costs and increasing the efficiency of finance departments was discussed. An initial insertion into internal flows is expected, creating groups of users with specific access levels, keeping all operations transparent and facilitating analytical activities thanks to the speed and homogeneity of the data transmitted.

The next step? The implementation in business networks, with the automation of procurement processes through real time notification systems, the constant and shared monitoring of assets available for sale and purchase and, again, the generation of precise, gradual barriers to entry for participation in the exchange. It would be a quantum leap. But the ability to adapt that businesses strengthened by digital disruption have demonstrated gives us hope.

However, much may also depend on the willingness of technology vendors to first understand, then embrace and finally implement the Blockchain logic in their offering. There are those who are already thinking about it. But the game is interdisciplinary, as well as international, and in addition to developing technical solutions that respond to concrete – and still unsolved – problems, an important work of information and awareness is also needed to involve institutions and associations in the definition of adequate regulatory systems.

Blockchain, standards and institutions

Companies, organizations and above all Public Administrations when they have to face analysis and “decision” processes regarding the evaluation and adoption of innovative technologies such as blockchain, direct their research towards three major information areas:

the possibility of accessing documented case histories that can provide orientation regarding the results of concrete experiences.

the availability of shared standards or, where these are not yet available, the visibility with respect to working groups and international discussion tables that work on these issues

knowledge of the professionals, skills or paths and actors on the training level who are in a position to make available figures with appropriate skills

Other forms of blockchain: Ethereum

What is Ethereum

Ethereum is a computational platform that is “remunerated” through exchanges based on a cryptocurrency calculated in Ether. It is a platform that can be adopted by all those who wish to become part of the Network and who will thus have a solution at their disposal that allows all participants to have an immutable and shared archive of all the operations implemented during the time and which at the same time is designed so that it cannot be stopped, blocked or censored.

- Ethereum could be presented as the largest shared computer that is capable of delivering enormous power available everywhere and forever.

- So with Ethereum we move from the concept of Distributed Database to Distributed Computing.

- Ethereum is designed to be adaptable and flexible and to easily create new applications.

That is, Ethereum is a Programmable blockchain that does not limit itself to providing predefined and standardized “operations”, but allows users to create their own “operations”. In fact, it is a Blockchain platform that allows you to create different types of decentralized Blockchain applications not necessarily limited to just cryptocurrencies.

Ether: the trading currency of Ethereum

The use of Ethereum’s computational resources is remunerated with a special “virtual currency” called Ether which itself represents both the processing power necessary to produce the contracts and the cryptocurrency that allows you to “pay” for the creation of the contracts. Ether is basically and concretely a token that is treated as a cryptocurrency exchange with the ticker symbol of ETC.

Ethereum then counts on an Internal Transaction Pricing Mechanism called Gas which has the purpose of optimizing the network’s resources, preventing spam and allocating resources in a proportionate and correct manner based on requests.

Ethereum Virtual Machine EVM: the “engine” of Ethereum

Ethereum is a “Turing complete” system that allows developers to create applications that run on the EVM using programming languages that in turn reference traditional platforms such as JavaScript and Python.

The Ethereum engine is represented by the Ethereum Virtual Machine (EVM) which effectively represents the runtime environment for the development and management of Smart Contracts in Ethereum. EVM operates in a protected manner, i.e. it is completely separated from the Network. The code managed by the Virtual Machine does not have access to the Network and the Smart Contracts generated are independent and separate from other Smart Contracts.

In 2016, Ethereum was split into two different Blockchains Ethereum Classic and Ethereum Foundation.

Who is Ethereum Foundation

Ethereum Foundation (to find out more go to the Ethereum Foundation website) is the organization that aims to manage all development, research and support activities of the Ethereum platform. In 2014 when the team of developers composed of Vitalik Buterin together with Anthony Di Iorio, Mihai Alisie and Charles Hoskinson Ethereum also became a reality in the form of a business with the Swiss company Ethereum Switzerland GmbH. It was then the non-profit Ethereum Foundation that took the reins of the project.

Ethereum was characterized by a series of prototypes and development actions financed and managed by the Ethereum Foundation on the basis of the concept and project of Proof of Concept until the launch of the Frontier network project with the aim of improving security and usability. Among the various initiatives, the Olympic project should be highlighted, which had among other things the aim of testing the performance and limits of the Ethereum Blockchain network with a “Stress Test”. With the Olympic project comes the aforementioned Frontier network. More recently, the Ethereum Foundation is involved in the Homestead project designed to improve the transactional component, the Gas logic for pricing management and security. Alongside Homestead, the Metropolis project is active, aimed at simplifying the use of the Ethereum Virtual Machine and allowing developers to act with greater flexibility and speed. Yet another project, Serenity should bring a series of innovations in the management logic of the algorithm that manages Ethereum consensus.

Who is Ethereum Classic

Ethereum Classic is the result of an important division in the original core of Ethereum at the level of the Ethereum Foundation. In particular, Ethereum Classic (go to the official website for more information) is made up of Ethereum members who have decided to create a “new” version of Ethereum, effectively not sharing the development lines of the Ethereum Foundation. Ethereum Classic is managed by a different team than Ethereum Foundation.

Ethereum Classic is a network that in the intentions of its promoters remains 100% compatible with Ethereum technology, but with a series of services designed to increase security and usability. Ethereum Classic is based on the development of a non-hackable Blockchain and has developed a token issuance strategy in proportion to the development of the network over time, with the aim of limiting the risks of deflation of the cryptocurrency.

What happened with The DAO and why it matters for Ethereum

The DAO event (acronym for Decentralized Autonomous Organization) gave rise to the fork of the Ethereum Blockchain and is important for understanding the evolutionary logic and rules of the Blockchain themselves.

The DAO was to all intents and purposes a “Decentralized autonomous organization”, an organization created on the Ethereum Blockchain characterized by the fact of being a “virtual” organization, i.e. without an office, without a legal personality, without figures clearly identifiable as administrators).

The DAO intended to raise capital (through the exchange of DAO Tokens for ETH) to invest in projects that were previously evaluated by a committee and then put to the DAO Token holders to vote. The latter could express their vote (proportional to the quantity of DAO Tokens owned) to determine which projects the capital would then be disbursed.

In concrete terms, The DAO was created with a series of steps typical of an ICO: website to provide information, dissemination of a whitepaper in which the project is described, audit of the source code of the smart contracts used, agreements with some “exchanges” to allow the exchange of tokens once acquired, etc.

Within a few months, the organizers of The DAO managed to raise around 150 million dollars. But due to a violation of the address where the ETH received by the organization on June 18, 2016, approximately $70 million was lost in a few hours.

The affair gave rise to a series of discussions and comparisons and led to a split of the Ethereum Blockchain and led the SEC to analyze the affair to understand whether or not it can be traced back to the activity of placing financial instruments and, consequently, in order to examine whether the “Securities Law” had been applicable in the specific case and this investigation highlighted that

In the case of The DAO, investors had exchanged Ether (which had a value determined on the market) with DAO Tokens;

-

- The investment was made with an expectation of profit (which can generally be dividends, periodic payments, increase in value).

- The DAO’s promotional materials highlighted its goal of creating a for-profit entity aimed at funding projects in exchange for a return on investment;

- The expectation of return on investment depended on the management efforts of others, given that The DAO’s organization on decisions regarding the projects to be financed was absolutely top-down.

These considerations have led the SEC to consider the DAO Tokens as financial instruments, with consequent application of the Securities Law from which derives the obligation for the issuing body to register the offers and sales of the instruments and, correlatively, with the consequent registration obligation for the entities that offered trading platforms for the aforementioned tokens such as “national securities exchanges”.

Ethereum and Ethereum Classic: what are the differences?

Ethereum represents the “official” version of the Blockchain and is managed and updated by the developers who designed and created it, while Ethereum Classic is a Blockchain which, starting from Ethereum, presents itself as an evolution or as a form of “alternative”.

The reason that led to this division is linked to a specific hacking event that hit an Ethereum project (precisely, The DAO) and which had led the Ethereum community to change the Ethereum code to remedy the consequences of this hacker attack . This decision has opened a fracture on the very concept of Blockchain, or rather on the underlying principles of this paradigm.

On one side there were all those who argued that Blockchains live on the principle of community and it is the majority of the community that decides on the possible evolutions of the Blockchain itself.

And based on this belief, if the majority of the community agrees, the Blockchain can be modified. Then there is a different school of thought which instead claims that the Blockchain cannot be modified, it must be firmly protected from any form of tampering.

This division placed developers at a crossroads and the so-called “purists”, when Ethereum created a new Blockchain, chose to continue operating on the old version of the Blockchain. In concrete terms, with this step, two Ethereum Blockchains were created and in particular Ethereum Classic today operates as a parallel version of the Blockchain.

NEM Foundation, NEM Blockchain, XEM

NEM Foundation is a non-profit organization based in Singapore that gathers members around the world. The foundation has the mission of following, stimulating and supporting the developments of the Blockchain NEM technology and aims to encourage the development and extension of an ecosystem of NEM users both at the level of developers and within the fields of use of the Blockchain NEM in industry, in universities and in Public Administrations. (Read here to learn more about NEM and its application areas.)

New Economy Movement

For many operators, NEM, which is the acronym for New Economy Movement, is an important cryptocurrency and a series of solutions for managing Blockchain-based services. But NEM is not just a “coin”, it is an ecosystem, started in 2015, which has also generated and fueled a cryptocurrency called XEM based on a token. In reality and in everyday life the two names have overlapped and NEM is currently used both to represent the phenomenon and for the name of the cryptocurrency. To be precise, the terms linked to the NEM world are therefore:

-

- NEM Foundation (the Foundation of the New Economy Movement)

- NEM Blockchain (on which services such as Smart Asset are based)

- XEM the cryptocurrency NEM

NEM is therefore not just a cryptocurrency, but is a vehicle of transactional information that “packages” a series of data that goes or can go well beyond the information linked to “payment”. Specifically, NEM is an interpretation of the Blockchain which is based on the Proof of Importance POI process, on an EigenTrust reputation control system (read HERE for more information), on multi-signature accounts and on encrypted messaging.

XEM cryptocurrency

But the “monetary” theme is only one of the themes underlying the New Economy Movement. NEM in fact also presents itself with a vocation and commitment in the social field, so much so that the founders underline the desire to use technology and the Blockchain to try to give new answers to the issues of inequality in the distribution of wealth. And XEM as a cryptocurrency aims to create a new form of circulation and sharing of value.

NEM’s “mission” can be summarized in three major objectives:

-

- Creation of an exchange environment characterized by equal opportunities

- Development of a context inspired by the principles of decentralization in the spirit of Blockchain

- Creating an environment capable of encouraging the development of greater financial freedom

To “explain” NEM it is perhaps important to start explaining the logic of Proof of Importance. In fact, it should be immediately specified that at the basis of the Blockchain logic developed by NEM there is a new form of consensus or rather a new Consensus Protocol which NEM has defined as Proof of Importance.

The “Proof of Importance” is activated thanks to a process similar to the one followed by the Proof of Stake, (read HERE for more information on the Proof of Stake), but adds a series of variables such as network clustering and above all new criteria ranking.

What is Proof of Importance

For the Proof of Importance an algorithm has been developed which is used in NEM transactions and which allows the importance of a specific user to be established based on the quantity of XEM present within the account and depending on the number of transactions he carries out with his wallet.

The importance of a NEM user’s transaction is determined both by the amount of currency and by the number and quality of transactions carried out. The POI uses a ranking system called NCDawareRank which allows you to measure and monitor all the signals that determine a consensus. The POI works to evaluate NEM transactions primarily based on criteria such as volume and trust of each transaction.

The characteristics of some of the main blockchains

The fundamental characteristics of the main blockchains in the table created by the Blockchain Observatory of the Polytechnic of Milan

ICO Blockchain: what it is why it is important to know it

One of the developments of Blockchain concerns the field of Crowdfunding and financing in the form of Venturing for startups. The ICO (Initial Coin Offering) is an innovative Crowdfunding method totally based on cryptocurrencies.

The Initial Coin Offering (otherwise also defined as Initial token offering or token sale) is bringing a series of important innovations to the world of Venturing and represents in all respects a sort of IPO (Initial Public Offering) entirely managed with cryptocurrency on the Blockchain .

The ICO is a revolutionary tool in the world of Venturing because it allows us to overcome the rigid rules of the evaluation processes traditionally followed by funds and banks to which we have been accustomed in recent years. However, this is an operation aimed at new companies that operate in the Blockchain sector or that have developed or are developing solutions based on the Blockchain. In concrete terms, the ICO is implemented with the sale of tokens by the startup that is looking for resources on the market.

Tokens can be “exchanged” for cryptocurrencies such as Bitcoin or Ether. The investment proposal which is implemented through the “sale” of tokens is based on the presentation of an industrial plan or business project. The ICO, like the IPO, is designed to “give trust” and resources to an idea, which specifically aims to grow the Blockchain and finds its consensus in the community that operates on the Blockchain. The tokens, the object of the investment, can be exchanged to all intents and purposes and, like the shares of a listed company, their nominal value can vary depending on many factors, starting from the progress of the project presented and the fluctuations of the cryptocurrencies.

What exactly is an Initial Coin Offering

The issuing of tokens for the remuneration of verification and control “services” has allowed the creation of a new financing method which has taken on the name of Initial Coin Offering precisely because of the role that the Coins are called upon to play in promoting development of the company itself. The token is issued to investors in exchange for digital currency and at the same time investors can use the tokens received to enjoy the innovative services provided by the startup or they can sell them when the market appreciates them and can guarantee a markup.

The American startup Protocol Labs Inc., for example, received funding of several million dollars thanks to an ICO with the aim of building a Blockchain network where storage space can be bought and sold using “Filecoins” or tokens issued by Protocol same for the ICO financing request. In this way, if the company is successful in creating this digital storage marketplace, the value of Filecoins will most likely rise. Lenders can use Filecoins to purchase storage space or can exchange them to sell their stake in the company with Filecoins themselves.

To understand the ICO we need to start from Crowdfunding

But to understand the value of the ICO we need to look at the logic of crowdfunding. If you consider that in 2015 alone, crowdfunding platforms made it possible to raise financing for something like 34 billion dollars, you understand the reasons for the consensus that surrounds and accompanies this method of financing for startups and investors.

The ICO takes crowdfunding to a new level, thanks to the help of technology and thanks to the logic of the Blockchain it is possible to link the value of the investment with the value of the community that believes in that investment. Token tokens express the value of the asset and are a “security” that can be used by all participants to actively contribute to making the company in which they invest work and to increase its value.

The technological aspect of tokens and therefore of ICOs is complex and articulated, but there is one point that must be underlined in particular. The transactional conditions linked to the tokens are not “only” defined during the ICO phase, but are “written” in the code of the tokens themselves.

The ICO can rely on the logic of smart contracts, guaranteeing maximum transparency, openness and traceability on every single transaction. Auditing operations, for example, can be speeded up and even automated. The transparency linked to automated smart contracts allows the creation of escrow accounts for the management of funds linked to the recognition of values that are activated only upon the achievement, automatically verified and controlled by the smart contracts, of certain objectives.

The substantial difference between ICO and IPO

While on the one hand ICO and IPO respond to the same need with a similar implementation logic, it must be said that in the case of the IPO all operations are subject to the control of a supervisory institute which in our country is represented by Consob which has the task of supervise the correctness of the purchasing procedures and the operations of the companies involved. In the case of the ICO there is no reference body for control.

Blockchain and GDPR

The GDPR was created to “regulate” the management of privacy linked to the use of user data on the web, apps and social media by web and media companies that are trying to build their competitive advantage on user profiling. It is very important to understand the relationship between Blockchain and GDPR because it can open up new forms of security management in the form of Privacy by Design. The GDPR can be “interpreted” as a “Digital Bill of Rights” for people.

The GDPR regulation in summary

The heart of the GDPR is the protection of people’s data, in other words the individuals to whom that data belongs. In a very concise way, this is what the GDPR introduces on the topic:

Art. 12: people have the right to ask and receive answers about the use that a company will make of their data and to request compensation if these questions do not have clear, concise and timely answers;

Articles 13 and 14: users have the right to know how personal data will be used at the time of their collection/request and to know how long they will be kept;

Art. 15: users have the right to know and access the personal data that is elaborated/processed by those who have requested consent;

Art. 16: people can rectify and modify their personal data

Art. 17: users have the right to request (and obtain) the deletion of their personal data when they are no longer necessary for the purposes for which they were collected;

Art. 18: people can limit the processing of their data (when they are inaccurate, when they have been collected illegally or not following legal procedures…);

Art. 19: whoever collects the data must also inform the “third parties” authorized to use them to stop the use of the rectified or deleted data);

Art. 20: users have the right to their personal data in a structured and commonly used format so that they can be easily read by any machine (PC, smartphone, app, etc.);

Art. 21: people have the right to object to the use of their data for profiling or marketing and must be able to say no.

The role of legislation and privacy

According to the World Economic Forum, by 2025 as much as 10% of the world’s GDP will be produced by activities and services that will be provided and distributed through Blockchain technologies. In this scenario, the management of governance in relation to regulations appears fundamental, first of all the GDPR (the European general regulation on data protection.

The possible relationships between GDPR and Blockchain

The GDPR regulation impacts a series of areas that relate to the specific characteristics of the Blockchain:

-

- Data access and visibility – The data inserted into the Blockchains is public and accessible by anyone participating in the chain

- Data deletion – the data stored in a Blockchain is tamper-proof, so its deletion will not be possible once such data is entered into the distributed chain;

- Immutability of data over time – the data present in Blockchains are stored indefinitely and cannot be modified, tampered with or deleted.

- Distributed data control – Blockchains are distributed so control over data cannot be centralized and is the responsibility of all Blockchain participants (i.e. it is difficult to identify the Data Protection Officer figures required by the GDPR);

- Automated decision-making processes – with Smart Contracts, automated decision-making processes must also be considered, i.e. a new type of data management

Blockchain and GDPR for Security by Design

Blockchain and GDPR allows you to create “security by design” solutions by ensuring pseudo nymisation (decoupling of data from individual identity) and data minimization (sharing only absolutely necessary data points).

We remind you that in the Blockchain, data protection is ensured by a public key of the sender of the transaction; from a public key of the recipient of the transaction; from a cryptographic hash of the transaction content; from the date and time of the transaction.

With this setting it is impossible to reconstruct the content of a transaction from the one-way cryptographic hash. And unless one party to the transaction decides to link a public key to a known identity, it is not possible to map and link transactions to individuals or organizations. This means that even though the Blockchain is “public” (where anyone can see all transactions on it), no personal information is made public.

Blockchain, GDPR and legislative issues

The GDPR introduces some rules that may not always be respected by Blockchains.

GDPR and Data Protection Officer – The GDPR introduces the figure of the DPO – Data Protection Officer, a person expert in legislation and practices relating to data protection who must assist the person who controls or manages them in order to verify internal compliance with the regulation . The DPO must be a person with a good command of IT processes, data security and other business consistency issues regarding the maintenance and processing of personal and sensitive data.

When is it necessary to appoint a personal data controller? In the GDPR, the data controller must be appointed in case the main processing activities require regular and systematic monitoring of data subjects on a large scale, in case the activities include large-scale processing of particular categories of personal data or of data relating to criminal convictions and offences, even when the processing is carried out by a public authority or public body.”

Which jurisdiction to apply for the law of which country – In case of disputes, which laws should be applied and whose jurisdiction is it? In situations where it is not possible to identify the entity processing personal data and the place where the data is processed, it is difficult to identify the jurisdiction that should be responsible for any legal assessment of the data processing.

Identification of personal data – In a Blockchain context, what can be recognized as personal data? A user’s identity (and therefore their sensitive data) is protected by a code that represents the public key to join the distributed network. From a regulatory point of view, it is necessary to understand what constitutes “personal data” in a Blockchain context: should public keys be considered personal data? Although a public key appears as pseudonymized data, it does not represent anonymous data and is very often associated with specific natural persons.

Data disseminated on every node of the network – Does Blockchain limit the scope of data collection and processing and its minimization? In a Blockchain (especially a public one) data is maintained on every node of the network – publicly accessible to anyone – regardless of the original purpose for which that data was entered and processed in the Blockchain. How does this typical feature of Blockchain fit into a regulatory context which provides that the specific purposes for which personal data are processed must be specified, explicit and legitimate and that personal data must be adequate, relevant and limited to the purposes for which are treated.

Immutability – Blockchains are virtually unchangeable and the data they contain is often impossible to update, delete, modify or correct. It is therefore necessary to also address at a regulatory level how the issue of the “right to be forgotten” can be managed within a Blockchain?

What does temporal data validation mean

The certification and validation of data is made up of multiple factors, among these a particularly important role is played by the so-called “temporal validation”. In the case of DAS, for example, a “rule” has been established according to which “digital temporal validation” concerns those data that connect other data in electronic form on a specific date (time, date) such that even from the point from a temporal point of view there is certain proof of their existence at that specific moment also in terms of relationship with other data. One of the themes that accompany the “legal” development of blockchain is also that of the validation of legal effects and their use in legal forms. Time validation systems are therefore an enabler not only of the “time factor” but thanks to the “time factor” and an associated electronic “seal” or “signature” it allows to increase the level of security relating to absolute reliability (and not only time) of that data. In other words, the security of the quality, integrity and reliability of the data on the blockchain also involves the tool of temporal verification.

IPDB is a database with a global vision and its governance is entrusted to a non-profit foundation. The members of the foundation are the “gatekeepers” of the network and each of them manages a server node that stores and validates transactions. Together these nodes constitute the IPDB database.

IPDB, can be identified as:

1) Network that manages a decentralized database;

2) Non-profit association, whose network transparently forms membership (following the Trust principles typical of the Blockchain).

IPDB is then based on the technologies already developed by BigchainDB, i.e. a Big Data database also designed for decentralized Data Science, to which the typical characteristics and functions of Blockchain technology have been added: decentralized control, immutability, creation and transfer of assets.

The members of the Foundation have foreseen that as the database progresses and the success of the project, we will even proceed towards the dissolution of the Association with complete decentralization also from an organizational point of view.

The application areas of the decentralized database concern the management of intellectual property in sectors such as Fintech, Banking, Payment, Energy and Supply Chain, Government.

Decentralized distributed database: governance

To avoid the risk of “utopia”, the IPDB model has chosen to be a voluntary association (which is called IPDB Foundation): guaranteeing legal personality to the network and in this way the Association can legally stipulate contracts, but, so that there are no ” ulterior motives” or personal profit purposes, it was decided that more than half of the custodians should be made up of other non-profit organizations or public bodies. Likewise, to avoid the risk of being subject to the laws of a single country, less than half of the custodians can come from the same country. All custodians must then be publicly committed to building a decentralized Internet.

Developers who intend to exploit the decentralized database and Blockchain technology to create services or applications are also asked to contribute: here is access to the portal dedicated to developers

Blockchain and “geography”

As we have said, blockchain has the characteristics of a “revolution”, it also presents disruptive characteristics, which can be destabilizing. For this and other reasons, there are very different approaches to blockchain in the world. There are countries or geographical areas that have “embraced” this cause (see Dubai, Estonia, Singapore), there are countries that are developing a very careful and pragmatic approach for example with intense work on the study of new regulations appropriate to the management of such an innovative phenomenon (like Switzerland, like Austria, like Malta and Gibraltar, like the United Kingdom). Then there is Europe which is looking for its own dimension and is doing so with a series of initiatives including the European Blockchain Partnership and finally there are countries which at the moment are looking at blockchain with perplexity or perhaps even skepticism.

In Italy we talk about it a lot, but…..it’s been a while now that we are no longer the center of the world…