Financial technology (FinTech or fintech) is the new technology and innovation that aims to compete with traditional financial methods in the delivery of financial services.[1] The use of smartphones for mobile banking and investing services[2] are examples of technologies aiming to make financial services more accessible to the general public. Financial technology companies consist of both startups and established financial and technology companies trying to replace or enhance the usage of financial services existing financial companies.

Definition

After reviewing more than 200 scientific papers citing the term “fintech,” the most comprehensive scientific study on the definition of fintech concludes that “fintech is a new financial industry that applies technology to improve financial activities.”[3]

FinTech is the new applications, processes, products, or business models in the financial services industry, composed of one or more complementary financial services and provided as an end-to-end process via the Internet.[2]

Key areas

Financial technology has been used to automate insurance, trading, and risk management.[4]

The services may originate from various independent service providers including at least one licensed bank or insurer. The interconnection is enabled through open APIs and supported by regulations such as the European Payment Services Directive.[5]

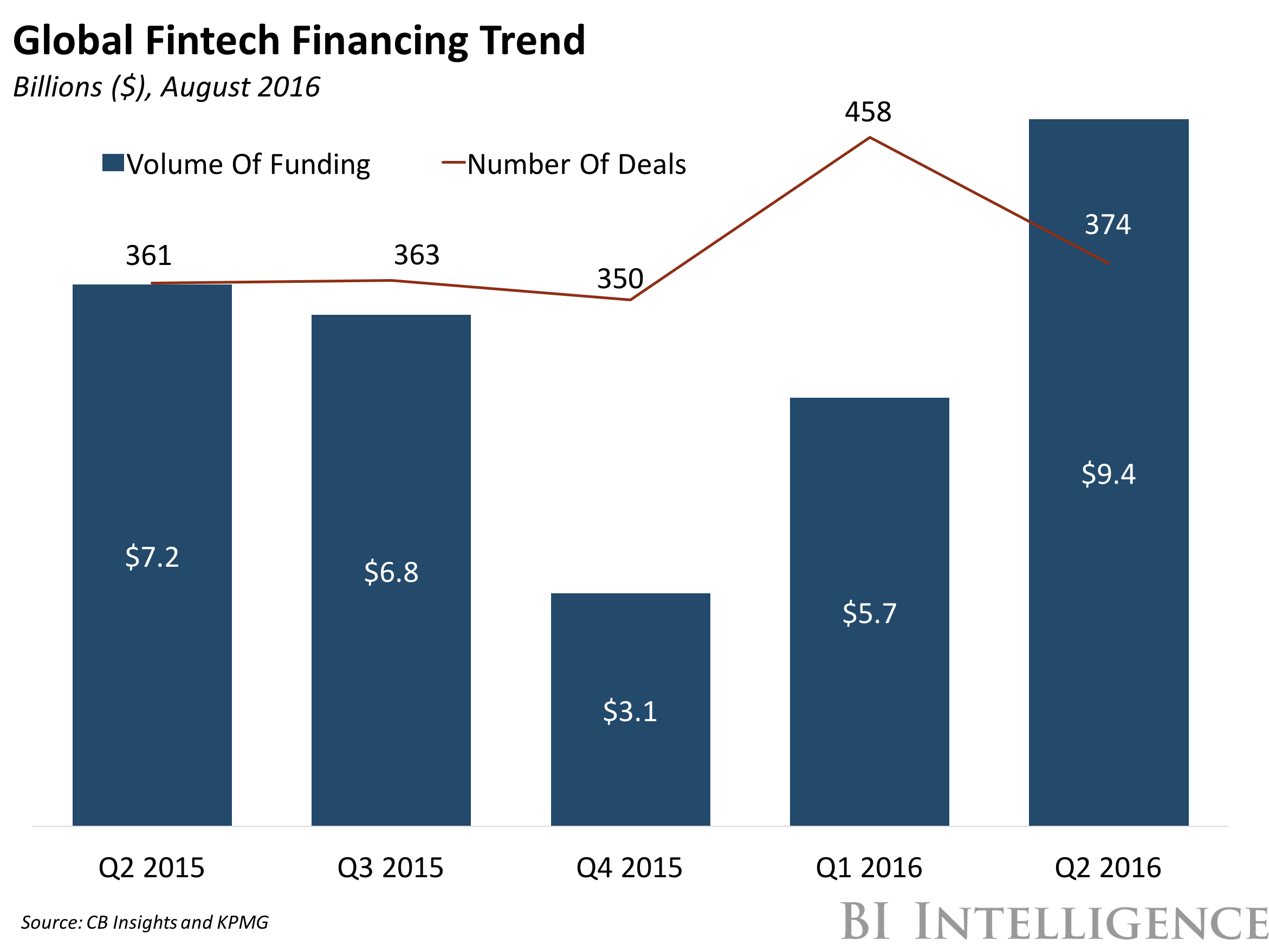

Global investment in financial technology increased more than twelvefold from $930 million in 2008 to more than $12 billion in 2014.[6] The nascent financial technology industry has seen rapid growth over the last few years, according to the office of the Mayor of London. Forty percent of the City of London‘s workforce is employed in financial and technology services.[7]

In Europe, $1.5 billion was invested in financial technology companies in 2014, with London-based companies receiving $539 million, Amsterdam-based companies $306 million, and Stockholm-based companies receiving $266 million in investment. After London, Stockholm is the second highest funded city in Europe in the past 10 years. Europe’s FinTech deals reached a five-quarter high, rising from 37 in Q4 2015 to 47 in Q1 2016.[8][9]

In the Asia Pacific region, the growth will see a new financial technology hub to be opened in Sydney, in April 2015.[10] According to KPMG, Sydney’s financial services sector in 2017 creates 9 per cent of national GDP and is bigger than the financial services sector in either Hong Kong or Singapore.[11] A financial technology innovation lab was launched in Hong Kong in 2015.[12] In 2015, the Monetary Authority of Singapore launched an initiative named Fintech and Information Group to draw in start-ups from around the world. It pledged to spend $225 million in the fintech sector over the next five years.[13]

Awards and recognition

Financial magazine Forbes created a list of the leading disrupters in financial technology for its Forbes 2016 global Fintech 50.[14]

A report published in February 2016 by EY commissioned by the UK Treasury compared seven leading FinTech hubs. It ranked California first for ‘talent’ and ‘capital’, the United Kingdom first for ‘government policy’ and New York City first for ‘demand’.[15]

Outlook

Finance is seen as one of the industries most vulnerable to disruption by software because financial services, much like publishing, are made of information rather than concrete goods. In particular blockchains have the potential to reduce the cost of transacting in a financial system.[16] While finance has been shielded by regulation until now, and weathered the dot-com boom without major upheaval, a new wave of startups is increasingly “disaggregating” global banks.[17] However, aggressive enforcement of the Bank Secrecy Act and money transmission regulations represents an ongoing threat to FinTech companies.[18]

In addition to established competitors, FinTech companies often face doubts from financial regulators like issuing banks and the Federal Government.[19]

Data security is another issue regulators are concerned about because of the threat of hacking as well as the need to protect sensitive consumer and corporate financial data.[20][21] Leading global Fintech companies are proactively turning to cloud technology to meet increasingly stringent compliance regulations.[22]

The Federal Trade Commission provides free resources for corporations of all sizes to meet their legal obligations of protecting sensitive data.[23] Several private initiatives suggest that multiple layers of defense can help isolate and secure financial data.[24]

Any data breach, no matter how small, can result in direct liability to a company (see the Gramm–Leach–Bliley Act)[25] and ruin a FinTech company’s reputation.[26]

The online financial sector is also an increasing target of distributed denial of service extortion attacks.[27][28]

Marketing is another challenge for most FinTech companies as they are often outspent by larger rivals.[29]

This security challenge is also faced by historical bank companies since they do offer Internet connected customer services.[30]

You think like I do! Spooky!

magnificent put up, very informative. I ponder why the opposite experts of this sector do not realize this. You should proceed your writing. I’m sure, you have a great readers’ base already!