Non solo Bitcoin: gli ambiti applicativi della Blockchain in Italia

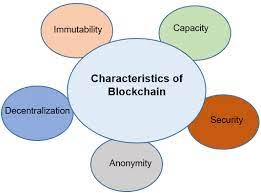

La Blockchain non è soltanto Bitcoin. La moneta virtuale è infatti solo una delle sue possibili applicazioni. Priva di gestione centralizzata, infatti, la Blockchain permette di inviare qualsiasi dato in maniera sicura, tagliando drasticamente la catena degli intermediari, e permettendo quindi uno scambio di dati sicuro tra due persone e basta, senza dover utilizzare mezzi di terze parti quali ad esempio un provider di posta elettronica, oppure un servizio di Cloud Computing esterno.

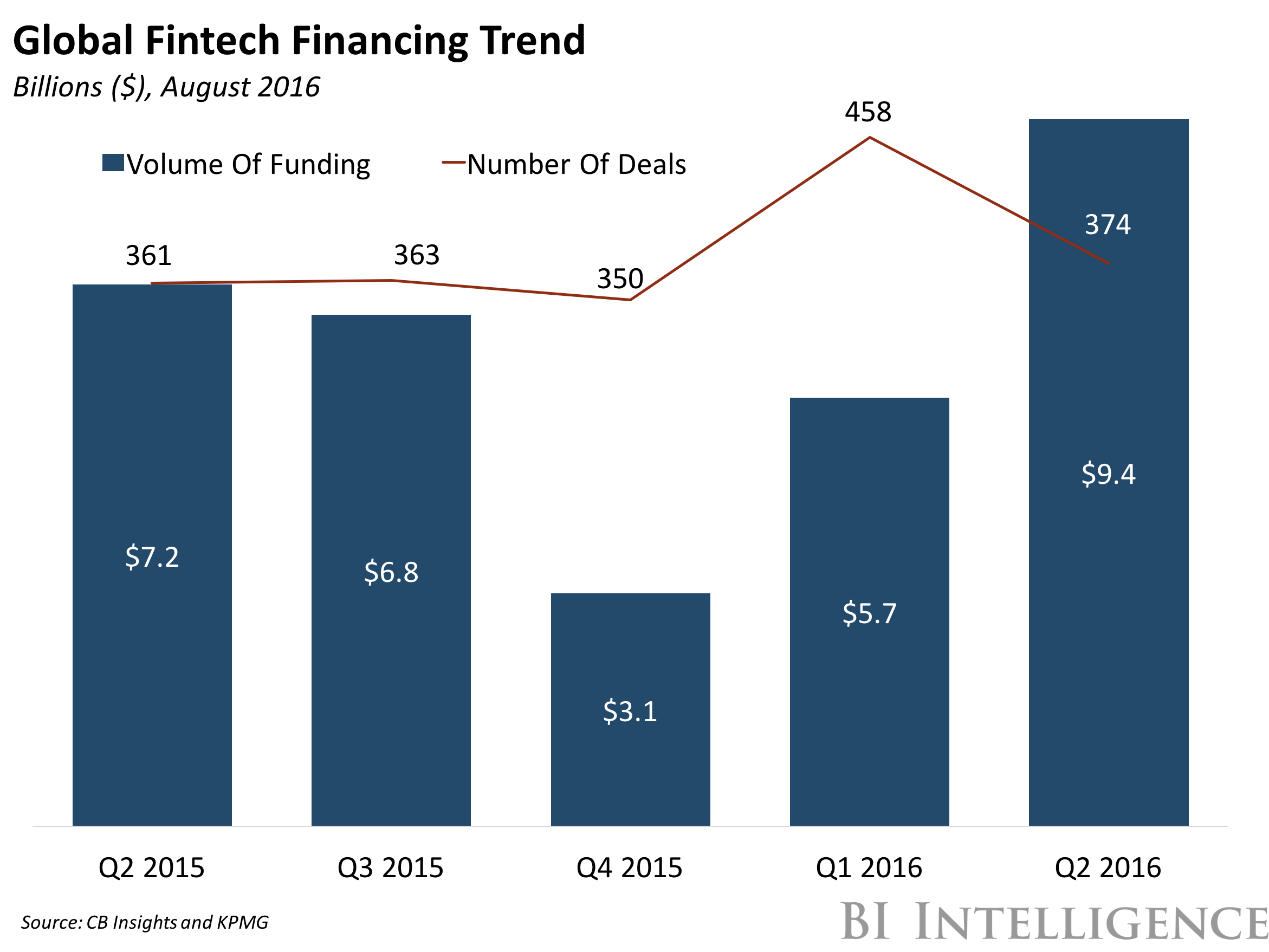

Il ruolo importante del Finance e la crescita del “Non Finance”

World Economic Forum

Si è parlato molto di Blockchain anche in occasione del World Economic Forum (Forum economico mondiale) e sono molti gli investitori che stanno puntando ad altri investimenti in ambito Blockchain, e quindi dagli investimenti iniziali che ci sono stati soltanto nella nuova valuta e in nuovi sistemi di pagamento, si passa finalmente a nuovi investimenti, in settori nuovi e diversi tra loro.

PWC

In una analisi realizzata da PWC nel 2018 con il coinvolgimento di 600 executive di 15 Paesi diversi, Italia inclusa, rappresentata da 46 rispondenti, è emerso che l’84 per cento dei rispondenti è coinvolto. In particolare, il 20% ancora è impegnato a livello ricerca, il 32% in fase di sviluppo, il 10% lavora a progetti pilota, il 15% è con la blockchain in produzione mentre il 7% dichiara di avere progetti avviati, ma per qualche ragione poi bloccati. Solo il 14% non ha alcun coinvolgimento, attivo o previsto sulla blockchain.

Deloitte

Secondo Deloitte sono stati investiti oltre 1 miliardo di dollari nella Blockchain, in oltre 120 startup collegate alla Blockchain, di cui oltre la metà di questi soldi sono stati investiti soltanto nel 2016 una conferma importante è poi arrivata nel corso del 2017 e dall’impegno e dagli investimenti di tante imprese nell’orizzonte temporale 2020.

Vediamo quindi quali sono i principali tra i nuovi ambiti applicativi della Blockchain in Italia e nel mondo.

1) Blockchain in Finanza e Banche

La Finanza e l’Economia sono sicuramente tra i settori presi più di mira dagli investitori in relazione alla Blockchain. Infatti, non essendoci intermediari a gestire le transazioni, la Blockchain abbatterebbe i costi delle commissioni delle banche, permettendo risparmi, velocità e affidabilità delle transazioni.

Diventa quindi fondamentale investire in questa nuova tecnologia per banche e istituti finanziari, che cercano di accaparrarsi una fetta abbastanza grande di questo nuovo mercato, che rivela già da subito innumerevoli possibilità e opportunità.

Su blockchain4innovation.it è disponibile la sezione dedicata alla Blockchain in Banche e Finanza, che offre una visione più ampia e un focus di approfondimento sul tema delle banche e della finanza in generale e su come questo mercato si stia evolvendo con un occhio di riguardo alla nuova tecnologia della Blockchain.

2) Blockchain nelle Assicurazioni

Inoltre, come evidenzia uno studio condotto da Ernst Young, c’è un’ottima possibilità di utilizzo anche per la Blockchain nel settore assicurativo (Assicurazioni). Alcuni modi attraverso i quali la Blockchain può aiutare le assicurazioni sono:

L’accesso a transazioni sicure e decentralizzate, che fornisce una base solida per prevenire le frodi, per garantire una maggiore governance, per avere dati e reportistiche migliori. Grazie alla Blockchain, inoltre, le assicurazioni possono avere notifiche aggiornate e accurate in relazione ai cambiamenti, e ciò permette loro di migliorare la gestione del rischio e massimizzare le opportunità di capitali e fondi, oltre alla possibilità di adottare strategie di Big Data, che sono molto utili per ottenere informazioni sicure sui propri clienti, sulle loro priorità e preferenze, oltre che eventuali ulteriori informazioni prese da terze parti.

Da un punto di vista tecnico, gli assicuratori vedono nella Blockchain un’opportunità per integrare un ecosistema di terze parti affinché riducano i costi delle loro piattaforme di gestione, migliorando allo stesso tempo l’esperienza utente (customer experience) e la quota di mercato, e sviluppando nuove soluzioni e opportunità.

A livello di mercato, inoltre, gli assicuratori hanno opportunità nella governance delle loro aziende, attraverso un accesso ai dati migliorato, controlli di terze parti e sistemi più sofisticati di gestione del rischio, associati ai loro prodotti e servizi, come ad esempio le assicurazioni cibernetiche.

3) Blockchain nei Pagamenti digitali

Anche per quanto riguarda i Pagamenti digitali ci sono grandi opportunità per la Blockchain. Ovviamente ci sono ancora molti problemi che vanno affrontati, come ad esempio il tempo di elaborazione di una transazione, che è ancora molto lento considerando le necessità di un mercato e un mondo che vanno sempre più veloce.

Anche le performance del sistema andrebbero migliorate, per poter essere meglio assorbite dai pagamenti digitali, e allo stesso modo indicazioni normative chiare e un’analisi più attenta di minacce e opportunità sono le sfide della Blockchain nel settore dei pagamenti digitali. Nonostante queste sfide, comunque, esistono tantissime opportunità per questa nuova tecnologia applicata ai pagamenti digitali, e probabilmente molto presto avremmo i primi riscontri dal mercato.

4) Blockchain nell’Agrifood

Nell’Agrifood la blockchain trova un ulteriore ottimo “alleato”. Alcune delle caratteristiche applicative della blockchain nell’Agrifood sono la tracciabilità, la trasparenza, di chi vuole “raccontare la storia” del proprio cibo, utilizzando la blockchain per garantire affidabilità. Altre aziende già oggi vogliono tracciare container e trasporti degli alimenti e del cibo in generale utilizzando la Blockchain.

In conclusione, i benefici della blockchain nell’Agrifood sono molteplici, e dalla decentralizzazione, al controllo condiviso, all’immutabilità e preservazione delle informazioni, ci sono sicuramente molte applicazioni per la blockchain in ambito Agrifood.

In particolare i benefici della blockchain appaiono particolarmente importanti per l’industria di trasformazione e per tutte le attività e gli sviluppi legati alla certificazione alimentare. La blockchain consente di creare delle filiere aperte in cui tutti gli attori: produttori di materie prime, imprese che si occupano di logistica e trasporti, imprese che operano sulle materie prime a vari livelli di trasformazione, aziende che lavorano su packaging e marketinge . infine il retail possono conferire dati e informazioni e controllare, con la massima trasparenza, i dati di tutti gli altri attori.

E i dati relativi a ciascun prodotto possono essere messi a beneficio del consumatore finale. La blockchain in questo modo permette di creare delle filiere più aperte, più efficienti e più sicure.

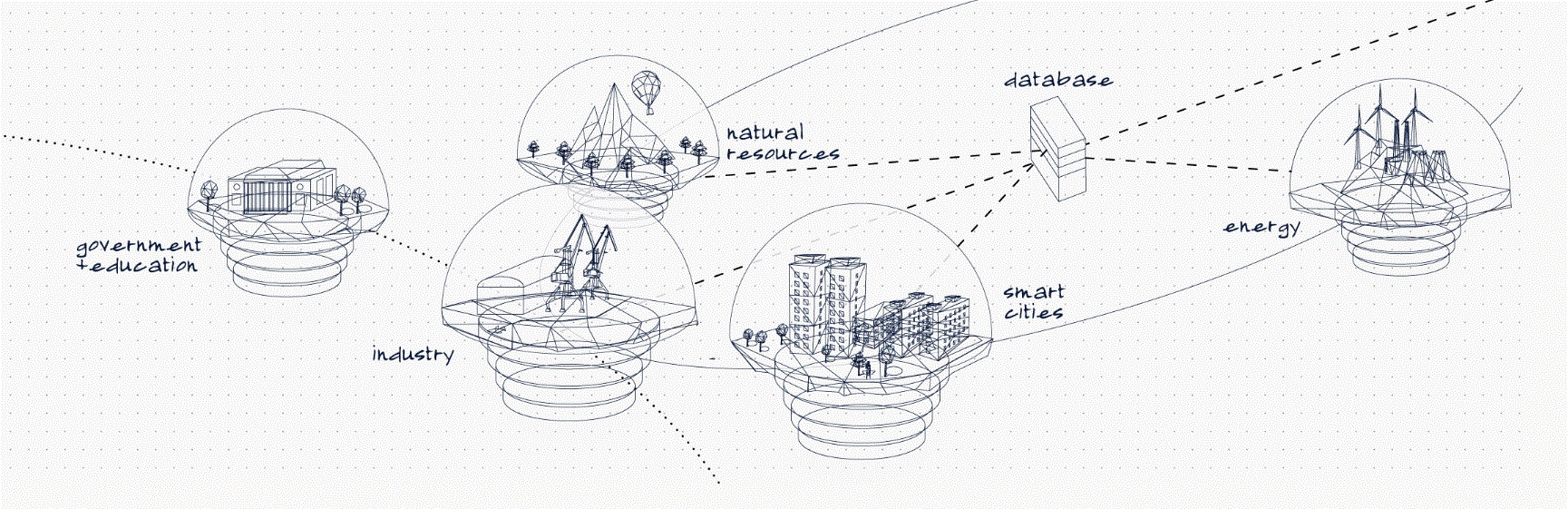

5) Blockchain nell’Industry 4.0

Anche nel manifatturiero la Blockchain può essere un valido alleato. Grazie alla Blockchain nell’Industry 4.0, infatti, è possibile sfruttare la logica decentralizzata della Blockchain per produrre tecnologie in grado di supportare al meglio la produzione, logistica e Supply Chain, così come altre aree “core” dell’azienda. Inoltre, grazie alla Blockchain, è possibile preservare il dato e la sicurezza del dato stesso, garantendo quindi sicurezza e affidabilità a tutto il processo della filiera produttiva e di distribuzione.

La Blockchain permette di disporre di soluzioni in particolare per le industrie di trasformazione, per la gestione della logistica di prodotto interna ed esterna e per la gestione dei rapporti di filiera. In particolare sono state sviluppate soluzioni che permettono di portare la logica del “Trust” che è ampiamente utilizzata nell’ambito dei pagamenti digitali anche nell’ambito delle transazioni che hanno come oggetto “pacchetti” di dati che rappresentano la identità di determinati prodotti e delle loro logiche di produzione.

In questi casi è necessario disporre della massima affidabilità in termini di gestione dell’identità e dell’affidabilità. In questo caso la Blockchain può rappresentare una eccellente soluzione per implementare le logiche dell’Industria 4.0 a livello distrettuale e di filiera.

6) Blockchain nell’IoT

Anche nell’Internet delle Cose la Blockchain trova una grande utilità: grazie alla sua facilità di scambio dati, infatti, la tecnologia Blockchain potrebbe essere utilizzata per facilitare la comunicazione tra oggetti IoT connessi, oltre a rendere lo scambio di dati più sicuro e veloce. La blockchain è poi utilizzata come piattaforma per soluzioni che hanno lo scopo di gestire l’identità delle cose.

Grazie alla corretta identificazione di questa identità è possibile dare vita a soluzioni di certificazione delle filiere basate anche sui dati che arrivano dalle cose (IoT) e lavorare alla certificazione di supply chain. Uno degli esempi più significativi è quello della food supply chain.

Ma perché è così importante la riconoscibilità – sicura – degli oggetti e dunque i temi dell’identity management nell’Internet of things? Oggi è importante rendere sempre più sicuro il riconoscimento end-to-end di oggetti virtuali o fisici, perché è con questi oggetti che si concretizza l’intermediazione delle persone stesse nelle transazioni.

Sono cioè gli oggetti che in definitiva gestiscono le transazioni. Noi oggi grazie a user ID e password o all’utilizzo di speciali certificati siamo in grado di identificare le persone, ma le persone si “fanno identificare” grazie a degli oggetti. In determinati casi – sempre più frequenti – ci sono ogetti che hanno bisogno di farsi identificare senza che dietro ci siano delle persone. Dunque se, grazie alla blockchain, si riescono a identificare gli oggetti avremmo un nuovo strumento di identificazione, più sicuro, anche per le persone.

7) Blockchain nella Sanità

Per quanto riguarda Blockchain e Sanità, gestire i dati medici dei pazienti attraverso un sistema condiviso, permetterebbe ai medici di condividere informazioni sui pazienti in maniera sicura e veloce, e quindi aiuterebbe molto la medicina e la sanità a migliorare il servizio fatto ai pazienti, con la possibilità di avere sotto controllo l’intera cartella clinica di un paziente, e quindi di conoscere in anticipo la storia del paziente, in modo da somministrare cure migliori e in tempi più rapidi.

La blockchain consente di dare vita a una organizzazione che realizza la vera centralità del paziente insieme al coordinamento intelligente di tutte le azioni mediche che lo interessano. Considerando che i servizi sanitari sono erogati da strutture diverse con “storie” digitali molto diverse la blockchain può aiutare a dare vita a un coordinamento intelligente di tutte le azioni grazie a una rivisitazione della gestione, dell’interoperabilità tra strutture e informazioni eterogenee.

Le tecnologie blockchain, per loro natura possono contribuire a dare risposte nuove in termini di interoperabilità progressiva fra sistemi informativi sanitari nazionali. La blockchain è anche una risposta in termini di compliance normativa (Gdpr, Nis Directive) in scenari complessi che devono gestire la presenza e la interazione tra sistemi sanitari interregionali, tra soggetti privati come possono essere i laboratori di analisi, le strutture della sanità privata o anche le assicurazioni.

La blockchain apre nuovi scenari per “migliorare le procedure di auditing, per la sicurezza, per ridurre i possibili attacchi, per la gestione dei dati dei pazienti per sviluppare nuove modalità di autenticazione. Non ultimo il tema degli Smart Contract” che possono velocizzare le procedure di controllo e i meccanismi operativi delle strutture ospedaliere e possono, unitamente ai servizi di data management, portare importantissime efficienze a livello di gestione documentale sicura.

Non va dimenticato che nel mondo sanitario c’è il grandissimo tema della moltitudine delle fonti. Non esiste ad esempio un registro unico nazionale per quanto riguarda le prescrizioni terapeutiche farmacologiche, ma si devono coordinare più sorgenti, spesso frammentate fra loro. la gestione documentale sicura, decentralizzata e “immutabile” può dare risposte nuove in termini di velocità di accesso ai dati che servono nel momento in cui servono.

8) Blockchain nella Pubblica Amministrazione

Anche la Blockchain nella Pubblica Amministrazione trova ambiti di applicazione. La Blockchain potrebbe infatti ad esempio aiutare la Pubblica Amministrazione e i cittadini ad avere una vera identità digitale, condivisa e implementata in questo sistema, con diversi vantaggi tra cui: rendere più difficile l’evasione fiscale, avere un controllo maggiore dei cittadini e quindi combattere la criminalità, servizi semplificati in tutti i settori della Pubblica Amministrazione (invio di dati semplificato), e molto altro.

9) Blockchain nel Retail

La Blockchain sembra essere un modello interessante da utilizzare nei negozi e nel Retail: con la Blockchain infatti gli attuali metodi di pagamento in negozio potrebbero essere estesi alla Bitcoin, permettendo quindi ai clienti pagamenti molto più rapidi, oltre che più economici. Garantendo pagamenti più veloci ed economici, e quindi più convenienti, può essere offerto un servizio migliore al cliente, che quindi potrebbe dare un vantaggio competitivo agli store che decideranno per primi di abilitare queste nuove tecnologie nei loro punti vendita.

10) Blockchain nella musica

La gestione del copyright è da sempre uno dei temi più controversi e complessi nell’ambito del mercato discografico. Un mercato questo che prima e più di altri ha vissuto una vera e propria trasformazione dettata dal digitale. Si può anzi dire che si tratta di un mercato che di trasformazioni ne ha vissute ben più di una e dove il tema della remunerazione di tutti gli attori della filiera è stato da sempre a dir poco complicato.

Lo scambio di brani musicali o la loro diffusione su larga scala, in assenza di una corretta remunerazione per gli autori e per chi, come arrangiatori e musicisti, contribuivano alla realizzazione del prodotto musicale, ha fatto discutere e ha visto tentativi di ogni tipo. Grazie alla blockchain, agli smart contract e all’iniziativa di diverse startup è oggi possibile automatizzare la remunerazione, in quota parte, della filiera di autori e contributori ai rani musicali, a ogni nostra scelta d’acquisto. Il punto determinante resta racchiuso in quest’ultima parola: scelta d’acquisto. Si deve trattare di una transazione, ovvero dell’acquisto di un brano o della sottoscrizione di un servizio.

11) Blockchain e Smart Grid

La “smart grid” porta il concetto di “rete intelligente” nell’ambito dell’energia elettrica. Siamo abituati da sempre a utilizzare, come consumatori, l’energia elettrica. Non siamo certamente abituati a vivere questa dimensione come produttori, anche se sempre più spesso ci troviamo o possiamo trovarci ad esserlo. La rete elettrica non è un rapporto univoco dal produttore al cliente ma conta una molteplicità di possibilità a partire dal cittadino che produce mette a disposizione sulla rete la propria energia.

Ma l’energia va prodotta quando serve o va utilizzata nel momento in cui se ne dispone in eccesso. In altre parole serve una gestione intelligente della produzione e dei consumi. Le Smart Grid utilizzano piattaforma di analytics e di scambio per gestire nel modo più preciso possibile consumi e produzione e naturalmente per ridurre al massimo gli sprechi.

La blockchain può svolgere un ruolo molto importante per la gestione delle transazioni in ingresso e in uscita con una modalità che permette di rendere più “democratica” la rete elettrica, ovvero una modalità che permette di gestire anche gli scambi tra coloro che hanno energia in eccesso e coloro che hanno necessità urgenti.

La società di ricerca Markets and Markets prevede una crescita del 78% nel 2018 nell’uso della blockchain per il mercato energy ma soprattutto prevede uno sviluppo del comparto che dovrebbe portare il rapporto blockchain – energia a generare un volume di business di oltre 7 miliardi di dollari nel 2023 a fronte di un volume che è nel 2017 era di poco inferiore ai 400 milioni di dollari. Tra le voci più importanti che sosterranno questa domanda la gestione dei pagamenti, gli Smart Contract, la gestione del pricing.

Da alternativa alla finanza tradizionale ad alleato delle banche

La tecnologia Blockchain invece un futuro ce l’ha eccome. In occasione degli eventi internazionali organizzati sul tema in questi mesi, a Londra (25-26 gennaio), San Francisco (10 febbraio) e Johannesburg (3-4 marzo), siederanno allo stesso tavolo colossi dell’IT – come IBM e SAP – e sviluppatori indipendenti, rivolgendosi a una platea internazionale composta prevalentemente da istituti finanziari e di credito.

L’interesse delle banche, del resto, non è più un segreto da tempo. Goldman Sachs ha dichiarato che la Blockchain è destinata a rivoluzionare il settore, mentre Barclays e USB hanno pubblicamente ammesso che potrebbero utilizzare la tecnologia su diversi ambiti operativi, dalle rimesse di pagamento alla contrattualistica. Bank of England ha fatto sapere di aver creato una serie di team di sviluppo all’interno della propria organizzazione. A settembre è invece nato R3, un consorzio privato istituti finanziari interessati al potenziale della Blockchain. A dicembre c’è stato un nuovo giro di adesioni, che ha visto l’ingresso di BMO Financial Group, Danske Bank, Intesa Sanpaolo, Natixis, Nomura, Northern Trust, OP Financial Group, Banco Santander,Scotiabank, Sumitomo Mitsui Banking Corporation, U.S. Bancorp e Westpac Banking Corporation. Oggi sono in tutto 42 gli istituti che hanno aderito alla federazione. Intanto in Italia anche il più grande istituto di credito, Unicredit, considera la Blockchain una delle priorità di investimento digitale del 2016 e del 2017.

Ma c’è anche chi è già passato dalle parole ai fatti: Bank of America ha depositato presso lo U.S. Patents and Trademark Office (USPTO) 15 brevetti correlati alla Blockchain e dovrebbe depositarne altri venti proprio in questi giorni. Stando a quanto reso pubblico dall’USPTO, i brevetti di Bank of America puntano a realizzare sistemi di identificazione dei rischi legati alle criptovalute e di allerta su utenti sospetti.

Ovviamente non manca il rovescio della medaglia. Se da una parte le banche sono attratte dalla possibilità di attivare transazioni più economiche e sicure, dall’altra l’idea che chi partecipa al network possa vedere in tempo reale i dati che circolano attraverso i nodi raffredda non poco gli entusiasmi di chi non vuole che i propri flussi transazionali diventino di dominio pubblico. È necessario, quindi, garantire che ciascun utente abbia le credenziali per vedere esclusivamente le operazioni che lo riguardano.

Si tratta di uno dei temi più dibattuti alla Blockchain Conference di Londra: insieme a quelli della regolamentazione e complessità degli strumenti di data protection da adottare sul piano della giurisdizione internazionale, è stato indicato come una delle questioni più delicate per la diffusione della tecnologia.

Gli altri possibili ambiti applicativi, dalla PA alle imprese

Ma non sono solo le banche a considerare la Blockchain una leva strategica di sviluppo. Se molti osservatori si dicono convinti che anche le pratiche della Pubblica Amministrazione e addirittura anagrafiche e documenti d’identità potranno essere gestiti sfruttando i sistemi di controllo distribuiti offerti dalla Blockchain (applicabili persino alle attività di notariato o alla gestione delle proprietà intellettuali), si comincia a valutare l’impatto positivo della tecnologia pure sulle imprese private.

Sempre a Londra si è discusso dell’utilità della Blockchain per semplificare i processi di business, diminuendo i costi e aumentando l’efficienza dei reparti finance. Si prevede un primo inserimento nei flussi interni, creando gruppi di utenti con specifici livelli di accesso, mantenendo trasparenti tutte le operazioni e agevolando le attività analitiche grazie alla rapidità e omogeneità dai dati trasmessi.

Il passo successivo? L’implementazione nei business network, con l’automazione dei processi di procurement attraverso sistemi di notifica real time,il monitoraggio costante e condiviso degli asset disponibili per la vendita e l’acquisto e, di nuovo, la generazione di precise, graduali barriere all’ingresso per la partecipazione all’interscambio. Sarebbe un salto quantico. Ma la capacità di adattamento che hanno dimostrato i business rafforzati dalla digital disruption fa ben sperare.

Molto però può dipendere anche dalla volontà dei vendor tecnologici di comprendere prima, abbracciare poi e infine implementare nella propria offerta la logica della Blockchain.

C’è chi ci sta già pensando. Ma la partita è interdisciplinare, oltre che internazionale, e oltre a sviluppare soluzioni tecniche che rispondano a problemi concreti – e ancora insoluti -, occorre anche un’importante opera di informazione e sensibilizzazione per coinvolgere istituzioni e associazioni nella definizione di adeguati impianti regolatori.

Blockchain, standard e istituzioni

Imprese, organizzazioni e soprattutto Pubbliche Amministrazioni nel momento in cui devono affrontare processi di analisi e di “decisione” in merito alla valutazione e all’adozione di tecnologie innovative come appunto la blockchain, indirizzano le loro ricerche su tre grandi ambiti informativi:

-

- la possibilità di accedere a case history documentate che possano fornire un orientamento in merito ai risultati di esperienze concrete.

- la disponibilità di standard condivisi o, laddove questi non siano ancora disponibili, la visibilità rispetto ai gruppi di lavoro, ai tavoli di discussione di profilo internazionale che lavorano su questi tematiche

- la conoscenza dei professionali, degli skill o dei percorsi e degli attori sul piano della formazione che sono nella condizione di mettere a disposizione figure dotate di appropriate competenze

Altre forme di blockchain: EthereumChe cos’è Ethereum

Ethereum è una piattaforma di tipo computazionale che viene “remunerata” attraverso scambi basati su una cryptocurrency calcolata in Ether. È una piattaforma che può essere adottata da tutti coloro che desiderano entrare a far parte della Rete e che in questo modo avranno a disposizione una soluzione che consente a tutti i partecipanti di disporre di un archivio immutabile e condiviso di tutte le operazioni attuate nel corso del tempo e che nello stesso tempo è concepita per non poter essere fermata, bloccata o censurata.

Ethereum potrebbe essere presentato come il più grande computer condiviso che è in grado di erogare una enorme potenza disponibile ovunque e per sempre. Dunque con Ethereum si passa dal concetto di Distributed Database a Distributed Computing.

Ethereum è progettata per essere adattabile e flessibile e per creare facilmente nuove applicazioni. Ethereum è cioè una Programmable blockchain che non si limita a mettere a disposizione “operation” predefinite e standardizzate, ma permette agli utenti di creare le proprie “operation”. Di fatto è una Blockchain platform che permette di dare vita a diverse tipologie di applicazioni Blockchain decentralizzate non necessariamente limitate alle sole cryptocurrency.

Ether: la moneta di scambio di Ethereum

L’uso delle risorse computazionali di Ethereum è remunerato con una speciale “moneta virtuale” denominata Ether che rappresenta essa stessa sia la potenza elaborativa necessaria per produrre i contratti sia la cryptovaluta che permette di “pagare” per la realizzazione dei contratti. Ether è fondamentalmente e concretamente un token che viene trattato come cryptocurrency exchange con il ticker symbol di ETC.

Ethereum conta poi su un Internal Transaction Pricing Mechanism denominato Gas che ha lo scopo di ottimizzare le risorse della rete, di prevenire lo spam e di allocare le risorse in modo proporzionato e corretto in funzione delle richieste.

Ethereum Virtual Machine EVM: il “motore” di Ethereum

Ethereum è un sistema “Turing complete” che permette agli sviluppatori di creare applicazioni che girano sulla EVM utilizzando linguaggi di programmazione che fanno a loro volta riferimento a piattaforme tradizionali come JavaScript e Python.

Il motore di Ethereum è rappresentato dalla Ethereum Virtual Machine (EVM) che rappresenta di fatto l’ambiente di runtime per lo sviluppo e la gestione di Smart Contract in Ethereum. EVM opera in modo protetto, ovvero risulta completamente separato dalla Rete. Il codice gestito dalla Virtual Machine non ha accesso alla Rete e gli stessi Smart Contract generati sono indipendenti e separati da altri Smart Contract.

Nel 2016 Ethereum è stata divisa in due diverse Blockchain Ethereum Classic ed Ethereum Foundation.

Chi è Ethereum Foundation

Ethereum Foundation (per sapere di più vai al sito di Ethereum Foundation) è l’organizzazione che ha come obiettivo la gestione di tutte le attività di sviluppo, di ricerca e di supporto della piattaforma Ethereum. Nel 2014 il team di sviluppatori composto da Vitalik Buterin insieme ad Anthony Di Iorio, Mihai Alisie e Charles Hoskinson Ethereum divenne realtà anche nella forma di impresa con la società svizzera Ethereum Switzerland GmbH. Fu poi la Fondazione no-profit Ethereum Foundation a prendere le redini del progetto.

Ethereum è stata caratterizzata da una serie di prototipi e di azioni di sviluppo finanziati e gestiti da Ethereum Foundation sulla base del concetto e progetto di Proof of Concept sino al lancio del progetto Frontier network allo scopo di migliorare sicurezza e usabilità. Tra le varie iniziative va segnalato il progetto Olympic che aveva tra l’altro lo scopo di mettere alla prova con uno “Stress Test” le performance e i limiti della rete Ethereum Blockchain. Con il progetto Olympic arriva poi il già citato Frontier network. Più recentemente Ethereum Foundation è impegnata nel progetto Homestead pensato per migliorare la componente transazionale, le logiche di Gas per la gestione del pricing e la sicurezza. Accanto a Homestead è attivo il progetto Metropolis finalizzato a semplificare l’utilizzo della Ethereum Virtual Machine e permettere agli sviluppatori di agire con maggiore flessibilità e velocità. Un altro progetto ancora, Serenity dovrebbe portare una serie di innovazioni nelle logiche di gestione dell’algoritmo che gestisce il consenso di Ethereum.

Chi è Ethereum Classic

Ethereum Classic è il frutto di una importante divisione nel nucleo originario di Ethereum a livello di Ethereum Foundation. In particolare Ethereum Classic (vai al sito ufficiale per avere maggiori informazioni) è costituito dai membri Ethereum che hanno deciso di dare vita a una “nuova” versione di Ethereum, di fatto non condividendo le linee di sviluppo di Ethereum Foundation.

Ethereum Classic è gestita da una diverso team rispetto a Ethereum Foundation. Ethereum Classic è un network che nelle intenzioni dei suoi promotori resta al 100% compatibile con la tecnologia Ethereum, ma con una serie di servizi pensati per aumentare la sicurezza e la usabilità.

Ethereum Classic è basata sullo sviluppo di una Blockchain non-hackerabile e ha sviluppato una strategia di emissione dei token in proporzione allo sviluppo della rete nel corso del tempo, allo scopo di limitare i rischi di deflazione della cryptovaluta.

Cosa è successo con The DAO e perché è importante per Ethereum

L’evento The DAO (acronimo di Decentralized Autonomous Organization) ha dato origine al fork della Blockchain Ethereum ed è importante per capire le logiche evolutive e le regole stesse della Blockchain.

The DAO era a tutti gli effetti una “Decentralized autonomous organization”, un’organizzazione creata su Blockchain Ethereum caratterizzata dal fatto di essere una organizzazione “virtuale”, ovvero senza una sede, senza una personalità giuridica, senza figure chiaramente identificabili come amministratori).

The DAO intendeva raccogliere capitali (tramite lo scambio di DAO Tokens a fronte di ETH) da investire su progetti che venivano previamente valutati da un comitato e poi posti in votazione ai possessori di DAO Token. Questi ultimi potevano esprimere il loro voto (proporzionale al quantitativo di DAO Token posseduti) per determinare a quali progetti sarebbero poi stati erogati i capitali.

In concreto The DAO è stata realizzata con una serie di passaggi tipici di una ICO: sito Internet per fornire informazioni, diffusione di un whitepaper in cui viene descritto il progetto, audit del codice sorgente degli smart contracts utilizzati, accordi con alcuni “exchange” per permettere lo scambio dei token una volta acquisiti, etc.

Nel giro di pochi mesi gli organizzatori di The DAO riuscirono a raccogliere circa 150 milioni di dollari. Ma a causa di una violazione dell’ indirizzo in cui erano allocati gli ETH ricevuti dall’organizzazione il 18 giugno 2016 in poche ore furono persi circa 70 milioni di dollari.

La vicenda diede luogo a una serie di discussioni e confronti e portò ad una scissione della Blockchain Ethereum e condusse la SEC ad analizzare la vicenda per comprendere la riconducibilità o meno della stessa nell’ambito dell’attività di collocamento di strumenti finanziari e, conseguentemente, per poter vagliare se nel caso di specie fosse stata applicabile la “Securities Law” e questa indagine evidenziò che:

-

- Nel caso di The DAO gli investitori avevano appunto scambiato Ether (che avevano un valore determinato sul mercato) con DAO Tokens;

- L’investimento era stato effettuato con un’aspettativa di profitto (che generalmente possono essere dividendi, pagamenti periodici, incremento di valore).

- I materiali promozionali di The DAO evidenziavano l’obiettivo di creare un’entità con scopo di lucro, finalizzata al finanziamento di progetti in cambio di un ritorno sull’investimento;

- L’aspettativa di ritorno dell’investimento dipendeva da sforzi gestionali altrui, dato che l’organizzazione di The DAO sulle decisioni in merito ai progetti da finanziare era assolutamente verticistica.

Tali considerazioni hanno indotto la SEC a ritenere i DAO Token strumenti finanziari, con conseguente applicazione della Securities Law dalla quale deriva l’obbligo per l’ente emittente di registrare le offerte e vendite degli strumenti e, correlativamente, con conseguente obbligo di registrazione per i soggetti che offrivano piattaforme di scambio (trading) dei suddetti token quali “national securities exchange”.

Ethereum ed Ethereum Classic: quali sono le differenze?

Ethereum rappresenta la versione “ufficiale” della Blockchain ed è gestita e aggiornata dagli sviluppatori che l’hanno ideata e realizzata, Ethereum Classic invece è una Blockchain che partendo da Ethereum si pone come una evoluzione o come una forma di “alternativa”. Il motivo che ha portato a questa divisione è legato a uno specifico evento di hackeraggio che ha colpito un progetto Ethereum (appunto, The DAO) e che aveva indotto la comunità di Ethereum di cambiare il codice di Ethereum per rimediare alle conseguenze di questo attacco hacker. Questa decisione ha aperto una frattura sul concetto stesso di Blockchain, ovvero sui principi di fondo di questo paradigma. Da una parte ci stavano tutti coloro che sostenevano che le Blockchain vivono sul principio della community ed è la maggioranza della community che decide sulle possibili evoluzioni della Blockchain stessa. E sulla base di questa convinzione se la maggioranza della community è d’accordo la Blockchain può essere modificata. C’è poi una diversa scuola di pensiero che invece sostiene che la Blockchain non può essere modificata, deve essere saldamente protetta da qualsiasi forma di manomissione.

Questa divisione ha posto gli sviluppatori davanti a un bivio e i cosidetti “puristi”, quando Ethereum ha creato una nuova Blockchain, hanno scelto di continuare a operare sulla vecchia versione della Blockchain. In concreto con questo passaggio si sono venute a creare due Blockchain Ethereum e in particolare Ethereum Classic opera oggi come una versione parallela della Blockchain.

NEM Foundation, NEM Blockchain, XEM

NEM Foundation è una organizzazione no-profit con sede a Singapore che raccoglie associati in tutto il mondo. La fondazione ha la missione di seguire, stimolare e supportare gli sviluppi della tecnologia Blockchain NEM e punta a incoraggiare lo sviluppo e la estensione di un ecosistema di utenti NEM sia a livello di sviluppatori, sia nell’ambito dei campi di utilizzo della Blockchain NEM nell’industria, nelle università e nelle Pubbliche Amministrazioni. (Leggi qui per approfondire la conoscenza di NEM e dei suoi ambiti applicativi.)

New Economy Movement

Per molti operatori NEM, che è l’acronimo di New Economy Movement, è una importante criptovaluta e una serie di soluzioni per la gestione di servizi basati sulla Blockchain. Ma NEM non è solo una “moneta”, è un ecosistema, avviato nel 2015, che ha generato e alimentato anche una critpovaluta denominata XEM basata su un token. Nella realtà e nella quotidianità le due denominazioni si sono sovrapposte e NEM è correntemente utilizzato tanto per rappresentare il fenomeno quanto per la denominazione della criptovaluta. Per precisione i termini legati al mondo NEM sono dunque:

-

- NEM Foundation (la Fondazione del New Economy Movement)

- NEM Blockchain (sulla quale si appoggiano servizi come Smart Asset)

- XEM la crytpocurrency NEM

NEM non dunque è solo una criptovaluta, ma è un veicolo di informazioni transazionali che “pacchettizza” una serie di dati che vanno o possono andare ben oltre le informazioni legate al “payment”. Nello specifico NEM è una interpretazione della Blockchain che si basa sul processo della Proof of Importance POI, su un sistema di controllo della reputazione EigenTrust (leggi QUI per maggiori informazioni), su account multifirma e sulla messaggistica criptata.

XEM cryptourrency

Ma il tema “monetario” è solo uno dei temi alla base del New Economy Movement. NEM in effetti si propone anche con una vocazione e un impegno in ambito sociale tanto che i fondatori sottolineano la volontà di utilizzare la tecnologia e la Blockchain per cercare di dare risposte nuove ai temi della disuguaglianza nella distribuzione della ricchezza. E XEM come criptovaluta si pone proprio dare vita a una nuova forma di circolazione e condivisione del valore.

La “missione” di NEM può essere sintetizzata in tre grandi obiettivi:

-

- Creazione di un ambiente di scambio caratterizzato da pari opportunità

- Sviluppo di un contesto ispirato ai principi del decentramento nello spirito della Blockchain

- Creazione di ambiente in grado di favorire lo sviluppo di una maggiore libertà finanziaria

Per “spiegare” NEM è forse importante iniziare a spiegare la logica del Proof of Importance. Va infatti subito precisato che alla base della logica Blockchain sviluppata da NEM c’è una nuova forma di consenso o per meglio dire un nuovo Protocollo di Consenso che NEM ha definito come Proof of Importance.

La “Prova di Importanza” si attiva grazie a un processo analogo a quello seguito dal Proof of Stake, (leggi QUI per avere maggiori informazioni sul Proof of Stake), ma aggiunge una serie di variabili come il clustering di rete e soprattutto nuovi criteri di ranking.

Che cos’è il Proof of Importance

Per il Proof of Importance è stato sviluppato un algoritmo che viene utilizzato nelle transazioni NEM e che permette di stabilire l’importanza di un determinato utente in base alla quantità di XEM presenti all’interno dell’account e in funzione del numero di transazioni che effettua con il suo portafoglio. L’importanza di una transazione di un utente NEM è determinata sia dalla quantità di currency sia dal numero e dalla qualità delle transazioni effettuate. Il POI utilizza un sistema di ranking denominato NCDawareRank che permette di misurare e monitorare tutti i segnali che determinano un consenso. Il POI opera in modo da valutare le transazioni NEM prevalentemente in base a criteri come volume e fiducia di ogni transazione.

Le caratteristiche di alcune tra le principali blockchain

Le caratteristiche fondamentali delle principali blockchain nella tavola realizzata dall’Osservatorio Blockchain del Politecnico di Milano

ICO Blockchain: che cos’è perché è importante conoscerla

Uno degli sviluppi della Blockchain riguarda l’ambito del Crowdfunding e dei finanziamenti in forma di Venturing alle startup. L’ICO (Initial Coin Offering) è una innovativa di modalità di Crowdfunding totalmente basata sulle cryptocurrency.

L’Initial Coin Offering (altrimenti definito anche come Initial token offering o come token sale) sta portando una serie di importanti novità nel mondo del Venturing e rappresenta a tutti gli effetti una sorta di IPO (Initial Public Offering) interamente gestita con cryptocurrency sulla Blockchain.

L’ICO è uno strumento rivoluzionario nel mondo del Venturing perché permette di superare le rigide regole dei processi di valutazione tradizionalmente seguiti da fondi e banche a cui siamo stati abituati negli ultimi anni. Si tratta però di una operazione che si rivolge alle nuove imprese che operano nell’ambito della Blockchain ovvero che hanno sviluppato o che stanno sviluppando soluzioni basate sulla Blockchain. In concreto l’ICO si attua con la vendita di token da parte della startup che sta cercando risorse sul mercato. I token possono essere “scambiati” con cryptocurrency come Bitcoin o come Ether. La proposta di investimento che si attua appunto attraverso la “vendita” di token è basata sulla presentazione di un piano industriale o di un progetto di impresa. L’ICO, come l’IPO, è disegnato per “dare fiducia” e risorse a una idea, che nello specifico punta a far crescere la Blockchain e trova il proprio consenso nella comunità che opera sulla Blockchain. I token, oggetto dell’investimento, possono essere a tutti gli effetti scambiati e, come le azioni di una impresa quotata, possono vedere variare il loro valore nominale in funzione di tanti fattori, a partire dall’andamento del progetto presentato e delle oscillazioni delle critpovalute.

Che cos’è esattamente una Initial Coin Offering

La emissione di token per la remunerazione di “servizi” di verifica e controllo ha permesso la ideazione di un nuovo metodo di finanziamento che ha assunto il nome di Initial Coin Offering proprio in ragione del ruolo che i Coin sono chiamati a svolgere nel favorire lo sviluppo dell’impresa stessa. Il token viene emesso verso gli investitori in cambio di digital currency e nello stesso tempo gli investitori possono utilizzare i token ricevuti per godere dei servizi innovativi erogati dalla startup oppure possono venderli nel momento in cui il mercato li apprezza e possono garantire un markup. La startup americana Protocol Labs Inc., ha ad esempio ricevuto un finanziamento di diversi millioni di dollari grazie a un ICO allo scopo di costruire un network Blockchain dove lo spazio storage può essere acquistato e venduto utilizzando i “Filecoin” ovvero i token emessi da Protocol stessa per la richiesta di finanziamento della ICO. In questo modo se la società ha successo nella creazione di questo marketplace di digital storage il valore dei Filecoin molto probabilmente a destinato a salire. I finanziatori possono usare i Filecoin per acquistare spazio storage o possono scambiarli per cedere con i Filecoin stessi la loro partecipazione nella società.

Per capire l’ICO occorre partire dal Crowdfunding

Ma per comprendere il valore dell’ICO occorre guardare alle logiche del crowdfunding. Se si pensa che solo nel 2015 le piattaforme di crowdfunding hanno permesso di raccogliere finanziamenti per qualcosa come 34 miliardi di dollari si capiscono le ragioni del consenso che circonda e accompagna questo metodo di finanziamento per presso le startup e presso gli investitori. L’ICO porta il crowdfunding a un nuovo livello, grazie all’aiuto della tecnologia e grazie alle logiche della Blockchain è possibile agganciare il valore dell’investimento con il valore della comunità che crede in quell’investimento. I token token esprimono il valore dell’asset sono un “titolo” che può essere utilizzato da tutti i partecipanti per contribuire fattivamente a far funzionare l’azienda nella quale si investe e per farne aumentare il valore.

L’aspetto tecnologico dei token e dunque delle ICO è complesso e articolato, ma c’è un punto che va sottolineato in particolare. Le condizioni transazionali legate ai token non sono “solo” definite in fase di ICO, ma sono “scritte” nel codice stesso dei token. L’ICO può appoggiarsi sulla logica degli smart contracts garantendo la massima trasparenza e apertura e tracciabilità su ogni singola transazione. La operazioni di auditing, ad esempio, possono essere velocizzate e addirittura automatizzate. La trasparenza collegata agli smart contracts automatizzati consente la creazione di conti di garanzia per gestione di fondi collegati al riconoscimento di valori che vengono attivati solo al raggiungimento, verificato e controllato automaticamente dagli smart contracts, di determinati obiettivi.

La differenza sostanziale tra ICO e IPO

Se da una parte ICO e IPO rispondono a una medesima esigenza con una logica di attuazione analoga va detto che nel caso della IPO tutte le operazioni sono soggette al controllo di un istituto di vigilanza che nel nostro paese è rappresentato dalla Consob che ha il compito di sorvegliare sulla correttezza delle procedure di acquisto e sulle operazioni delle imprese coinvolte. Nel caso dell’ICO non c’è un ente di riferimento per il controllo.

Blockchain e GDPR

Il GDPR nasce per “regolare” la gestione della privacy legata all’utilizzo dei dati degli utenti su web, app e social media da parte delle web e media company che sulla profilazione degli utenti stanno cercando di costruire il proprio vantaggio competitivo. E’ molto importante capire il rapporto tra Blockchain e GDPR perché può aprire a nuove forme di gestione della sicurezza in forma di Privacy by Design. Il GDPR può essere “interpretato” come una “Carta dei diritti digitali” delle persone.

La normativa GDPR in sintesi

Il cuore del GDPR è la protezione dei dati delle persone, in altre parole degli individui cui appartengono tali dati. In modo molto sintetico, questo è quanto introduce il GDPR sul tema:

Art. 12: le persone hanno il diritto di chiedere e avere risposte sull’uso che un’azienda farà dei propri dati e a chiedere un risarcimento qualora queste domande non abbiano risposte chiare, concise e tempestive;

Artt. 13 e 14: gli utenti hanno il diritto di sapere come verranno utilizzati i dati personali al momento della loro raccolta/richiesta e di sapere per quanto tempo saranno conservati;

Art. 15: gli utenti hanno il diritto di sapere e accedere ai dati personali che vengono elaborati/processati da chi ne ha chiesto il consenso;

Art. 16: le persone possono rettificare e modificare i propri dati personali (+

Art. 17: gli utenti hanno il diritto di chiedere (e ottenere) la cancellazione dei propri dati personali quando non sono più necessari agli scopi per i quali erano stati raccolti;

Art. 18: le persone possono limitare il trattamento dei propri dati (quando risultano inesatti, quando sono stati raccolti illegalmente o non seguendo le procedure giuridiche…);

Art. 19: chi raccoglie i dati deve informare anche le “terze parti” ammesse ad utilizzarli per interrompere l’uso dei dati rettificati o cancellati);

Art. 20: gli utenti hanno diritto a

i propri dati personali in un formato strutturato e comunemente usato in modo che possano essere letti facilmente da una qualsiasi macchina (Pc, smartphone, app, ecc.);

Art. 21: le persone hanno il diritto di opporsi all’utilizzo dei propri dati per profilazione o commercializzazione e devono essere messe nelle condizioni di poter dire di no.

Il ruolo della normativa e della privacy

Secondo il World Economic Forum, entro il 2025 ben il 10% del PIL del mondo sarà prodotto da attività e servizi che saranno erogati e distribuiti attraverso le tecnologie Blockchain. In questo scenario appare fondamentale la gestione della Governance in relazione alle normative, prima fra tutte il GDPR (il regolamento generale europeo sulla protezione dei dati.

Le possibili relazioni tra GDPR e Blockchain

Il regolamento GDPR impatta su una serie di ambiti che attengono alle specifiche caratteristiche della Blockchain:

-

- Accesso e visibilità dei dati – I dati inseriti nelle Blockchain sono pubblici e accessibili da chiunque partecipi alla catena

- Cancellazione dei dati –i dati archiviati in una Blockchain sono a prova di manomissione, quindi la loro cancellazione non sarà possibile una volta che tali dati verranno immessi nella catena distribuita;

- Immutabilità dei dati nel tempo – i dati presenti nelle Blockchain sono conservati illimitatamente e non possono essere modificati, manomessi o cancellati.

- Controllo distribuito dei dati – le Blockchain sono distribuite quindi il controllo sui dati non può essere centralizzato ed è in capo a tutti i partecipanti alla Blockchain (è difficile cioè individuare le figure di Data Protection Officer previste dal GDPR);

- Processi decisioni automatizzati – con gli Smart Contract si devono considerare anche processi decisionali automatizzati ovvero una nuova tipologia di gestione dei dati

Blockchain e GDPR per una Security by Design

Blockchain e GDPR permette di realizzare soluzioni di “security by design” garantendo pseudonimizzazione (disaccoppiamento dei dati dall’identità individuale) e la minimizzazione dei dati(condividendo solo i punti dati assolutamente necessari).

Ricordiamo che nella Blockchain la protezione dei dati viene assicurata da una chiave pubblica del mittente della transazione; da una chiave pubblica del destinatario della transazione; da un hash crittografico del contenuto della transazione; dalla data e dall’ora della transazione.

Con questa impostazione è impossibile ricostruire il contenuto di una transazione dall’ hash crittografico monodirezionale. E a meno che una delle parti della transazione non decida di collegare una chiave pubblica a un’identità conosciuta, non è possibile mappare e collegare le transazioni a singoli individui o organizzazioni. Ciò significa che anche se la Blockchain è “pubblica” (dove chiunque può vedere tutte le transazioni su di essa), nessuna informazione personale viene resa pubblica.

Blockchain, GDPR e questioni legislative

Il GDPR introduce alcune regole che non sempre potrebbero essere rispettate dalle Blockchain.

GDPR e Data Protection Officer – Il GDPR introduce la figura del DPO – Data Protection Officer, una persona esperta di legislazione e pratiche relative alla protezione dei dati che deve assistere colui che li controlla o li gestisce al fine di verificare l’osservanza interna al regolamento. Il DPO dev’essere una persona con una buona padronanza dei processi informatici, della sicurezza dei dati e di altre questioni di coerenza aziendale riguardanti il mantenimento e l’elaborazione di dati personali e sensibili.

“Quando è necessario nominare un responsabile del trattamento dei dati personali? Nel GDPR, il responsabile del trattamento deve essere nominato nel caso in cui le attività principali di trattamento richiedono il monitoraggio regolare e sistematico degli interessati su larga scala, nel caso in cui le attività comprendano il trattamento su larga scala di categorie particolari di dati personali o di dati relativi a condanne penali e reati, ancora quando il trattamento viene effettuato da una autorità pubblica o da un organismo pubblico.”

Quale giurisdizione applicare per la legge di quale paese – In caso di controversie, quali leggi devono essere applicate e di chi è la giurisdizione? In situazioni in cui non è possibile identificare l’entità di elaborazione dei dati personali e il luogo in cui i dati vengono elaborati, è difficile individuare la giurisdizione cui dovrebbe competere una eventuale valutazione legale del trattamento dei dati.

Identificazione dei dati personali – In un contesto Blockchain cosa può essere riconosciuto come dato personale? L’identità di un utente (e quindi i suoi dati sensibili) sono protetti da un codice che rappresenta la chiave pubblica per aderire alla rete distribuita. Da un punto di vista normativo occorre capire cosa costituisce “dato personale” in un contesto Blockchain: le chiavi pubbliche devono essere considerati dati personali? Sebbene una chiave pubblica figuri come dato pseudonimizzato, queste non rappresentano dati anonimi e molto spesso sono associate a persone fisiche specifiche.

Dati diffusi su ogni nodo della rete – La Blockchain limita lo scopo della raccolta e dell’elaborazione dei dati e la loro minimizzazione? In una Blockchain (specialmente se pubblica) i dati vengono mantenuti su ogni nodo della rete -pubblicamente accessibile a chiunque – indipendentemente dallo scopo originale per cui quei dati sono stati immessi ed elaborati nella Blockchain. Come si inserisce questa caratteristica tipica della Blockchain in un contesto normativo che prevede che gli scopi specifici per i quali i dati personali sono trattati devono essere specificati, espliciti e legittimi e che i dati personali devono essere adeguati, pertinenti e limitati agli scopi per i quali sono trattati.

Immutabilità – Le Blockchain sono praticamente non modificabili e i dati in esse contenuti sono spesso impossibili da aggiornare, eliminare, modificare o correggere. Occorre pertanto affrontare anche a livello normativo come si possa gestire il tema del “diritto all’oblio” all’interno di una Blockchain?

Cosa significa validazione temporale dei dati

La certificazione e validazione di un dato è costituita da molteplici fattori, tra questi un ruolo particolarmente importante è svolto dalla cosiddetta “validazione temporale”. Nel caso deI DAS, ad esempio, è stato stabilita una “regola” secondo la quale la “validazione temporale digitale” attiene a quei dati che collegano altri dati in forma elettronica in una data specifica (ora, data) tale per cui anche dal punto di vista temporale esiste una prova certa della loro esistenza in quel determinato momento anche in termini di relazione con altri dati. Uno dei temi che accompagnano lo sviluppo “giuridico” della blockchain è anche quello della validazione degli effetti giuridici e del loro utilizzo in forme legali. I sistemi di validazione temporale sono dunque un abilitatore non solo del “fattore tempo” ma grazie al “fattore tempo” e a un “sigillo” o “firma” elettronica associata permette di aumentare il livello di sicurezza relativa all’affidabilità assoluta 8e . non solo temporale) di quel dato. In altre parole la sicurezza della qualità, integrità e affidabilità del dato sulla blockchain passa anche attraverso lao strumento della verifica temporale.

IPDB è un database con una visione globale e con una Governance è affidata ad una fondazione no-profit. I membri della fondazione sono i “custodi” della rete e ognuno di essi gestisce un nodo del server che memorizza e convalida le transazioni. Insieme questi nodi costituiscono il database IPDB.

IPDB, può essere identificato come:

1) Rete che gestisce un database decentralizzato;

2) Associazione senza fini di lucro, la cui rete forma in modo trasparente la membership (seguendo i principi di Trust tipici della Blockchain).

IPDB è poi basato sulle tecnologie già sviluppate da BigchainDB, ossia un database di Big Data pensato anche per la Data Science decentralizzato, cui sono state aggiunge caratteristiche e funzionalità tipiche della tecnologia Blockchain: controllo decentralizzato, immutabilità, creazione e trasferimento di asset.

I membri della Fondazione hanno previsto che al progredire del database e del successo del progetto, si procede addirittura verso la dissoluzione dell’Associazione con la completa decentralizzazione anche dal punto di vista organizzativo.

Gli ambiti applicativi del database decentralizzato riguardano la gestione della proprietà intellettuale in settori come Fintech, Banking, Payment, Energia e Supply Chain, Government.

Database distribuito decentralizzato: la governance

Per evitare il rischio “utopia” il modello IPDB ha scelto di essere una Associazione di volontariato (che si chiama IPDB Foundation): garantendo personalità giuridica alla rete e in questo modo l’Associazione può legalmente stipulare contratti, ma, affinché non vi siano “secondi fini” o scopi di lucro personali, è stato deciso che più della metà dei custodi debba essere costituita da altre organizzazioni non profit o da enti pubblici. Allo stesso modo, per evitare il rischio di essere soggetti alle leggi di un unico Paese, meno della metà dei custodi può provenire dal medesimo Paese. Tutti i custodi poi devono essere pubblicamente impegnati a costruire una Internet decentralizzata.

Sono chiamati a contribuire anche gli sviluppatori che intendono sfruttare il database decentralizzato e la tecnologia Blockchain per creare servizi o applicazioni: qui l’accesso al portale dedicato ai developers

Blockchain e “geografia”

Come abbiamo detto la blockchain ha le caratteristiche di una “rivoluzione”, si presenta con caratteristiche anche dirompenti, che possono essere destabilizzanti. Per questa e altre ragioni nel mondo si registrano modalità di approccio alla blockchain anche molto diverse tra loro. Ci sono paesi o aree geografiche che hanno “sposato” questa causa (vedi Dubai, Estonia, Singapore), ci sono paesi che stanno sviluppando un approccio molto attento e pragmatico ad esempio con un intenso lavoro a livello di studio di nuove normative appropriate alla gestione di un fenomeno così innovativo (come la Svizzera, come l’Austria, come Malta e come Gibilterra, come il Regno Unito). C’è poi l’Europa che cerca una sua dimensione e lo sta facendo con una serie di iniziative tra cui la European Blockchain Partnership e infine ci sono paesi che in questo momento guardano con perplessità o forse anche con scetticismo alla blockchain.

In Italia se ne parla tanto, ma…..oramai è da un pezzo che non siamo più il centro del mondo…